Brex offers a corporate credit card that helps companies increase their spending power and grow faster. Get 10x -20x higher limits than traditional business credit cards while earning rewards and cashback on everything you spend, like 7x on Ride Share and 2x on recurring software.

What are the two types of Brex credit cards?

There are two versions of the Brex card:

One that pays daily and one that requires monthly payments, The Brex Corporate Credit Card is available to most small and medium-sized businesses (SMBs).

But as the company ramps up its software-as-a-service (SaaS) financial stack, it now offers the card only to venture-backed start-ups and mid-market companies.

Monthly Corporate Card:

The Brex Card is a charge card with several differences from a regular business credit card. Not only is it easy to qualify, but the Brex Corporate Card also has a credit limit of 10x to 20x that of most standard business credit cards.

Customers typically accept a credit limitation of 15% to 40% of the Cash in their guaranteed bank accounts. A monthly card is only available to companies that meet certain size and revenue requirements.

It’s an enterprise card for mid-to-large corporations or venture-backed tech start-ups with enough cash flow to handle payments. Most small and medium-sized businesses (SMBs) are not eligible. Customers typically receive a credit limit of 15% to 40% of the money in their deposit bank accounts.

Credit limits are 10-20 times higher than competitors. Plus, signing up for the Brex Corporate Card gives you a variety of discounts and credits for common business expenses in the tech enterprise.

And if you make the Brex credit Card your direct card, you can earn exceptional bonuses on spending like travel, food, and recurring software charges.

Daily Corporate Card:

All Brex Cash customers pay daily with a Brex Card. It is available to businesses of any size. In many ways, the Brex Everyday Card acts as a debit card to the Brex Cash Account.

Payments were automatically drawn from the Brex Cash statement at the end of each business day. The general credit limit is 100% of your Brex Cash account balance.

Clients can earn 8x Rewards points on the total card spent utilizing the company’s Brex card exclusively.

How does the Brex Cash account work?

Brex Credit Card Cash is a bank account for Brex customers without many of the drawbacks of traditional business bank accounts. Clients get free domestic and international wire transfers, ACHs, and mobile checks.

Brex Cash does not have fees associated with traditional bank accounts, such as minimum balance fees, overdraft fees, maintenance fees, return deposit fees, inactivity fees, and account closure fees.

The lack of a minimum balance fee comes from the need for minimum monthly credit.

What do you need to apply for a BREX Credit Card?

To apply for a monthly corporate card, you will need the following:

- Employer Identification Number (EIN).

- Business Bank Account Number

- Information on how they had funded your company (venture capital, investors, etc.).

There is no application for the daily credit card. Brex Cash Account customers automatically get a card when they create their accounts. Brex Corporate Cards are only available to companies that meet the following standards:

Venture-Backed Start-ups:

These include professionally funded, non-traditionally funded, and pre-funded companies.

Mid-market companies:

It is either a professionally funded company with 20 or more employees or a non-investment company with 50 employees.

Other important factors for Brex Credit Card

Eligibility and credit limit depend on your spending patterns, cash balance, and the amount you have raised from investors.

No credit check, personal guarantee, or collateral is required. If the business cannot repay its loan, the owner does not have to worry about personal assets being seized.

Now for the hard facts: Applicants generally need at least $50,000 in their business bank statement and at least $50,000 in monthly sales, depending on their business.

There is no annual payment and no foreign transaction fees. You can also earn unlimited cards for free to give to employees. Brex easily tracks all employee expenses in one convenient online tool. Without fees or interest rates, you’re probably wondering how Brex makes money.

Their partnership with MasterCard charges a merchant fee whenever somebody swipes the card. Brex makes Cash by taking a cut of those fees.

What are the benefits of a Brex Corporate Card?

We start with the qualification. It’s rare to find a business credit card that doesn’t require a credit check, personal guarantee, or collateral. A personal guarantee makes the business proprietor personally liable for business debts.

The credit card company can hold your assets if the business fails. Brex has no individual guarantee because they know that cardholders are uncomfortable risking their assets on a business that has only been active for a few months.

Young business owners may need a better credit history or use personal credit cards for expensive start-up costs. Not having an annual fee is rare, especially considering the vast rewards program.

And while other business credit cards have long applications, business owners can complete a Brex Corporate Card application in minutes. You can start using the virtual card as soon as you get approved, which is very helpful as it counts daily in business.

Finally, Brex’s sign-up bonuses and rewards program could save tech start-ups tens of thousands of dollars annually. HubSpot, Salesforce, and Zendesk are three top tools for tech start-ups that can become cheaper with the Brex Corporate Card.

Most tech entrepreneurs travel only a little, but virtually all start-ups have recurring software costs.

Brex gives back 2x points for these expenses and encourages start-ups to get more tools to succeed. Brex calculates that the total value of their association discounts equals about $150,000, but the actual amount depends on the services your company uses.

What are the disadvantages of a Brex Corporate Card?

The biggest disadvantage to the Brex Corporate Card is the limitation on companies that allow it.

As we mentioned, only venture-backed start-ups, professionally funded companies with at least 20 employees, or uninvested companies with at least 50 employees are eligible.

It excludes most small business owners, sole proprietors, and other businesses. Unless your business has steady revenue, paying back the entire balance every month can be a problem.

Therefore, new companies that still need to find their feet should look elsewhere for business credit cards. If Brex’s target market needs to be narrower, the card rewards program has an added need.

You cannot link other business credit cards to your business bank account. So, to access a rewards program, you need to be far enough along in your journey to earn significant funds but not far enough along to already have a business credit card.

If your company doesn’t fit these criteria, you may prefer a card with 7x points for another expense, such as travel or lodging. Although sign-up bonuses include various popular software tools, most tech start-ups use them sparingly.

How do you apply for a Brex Corporate Credit Card?

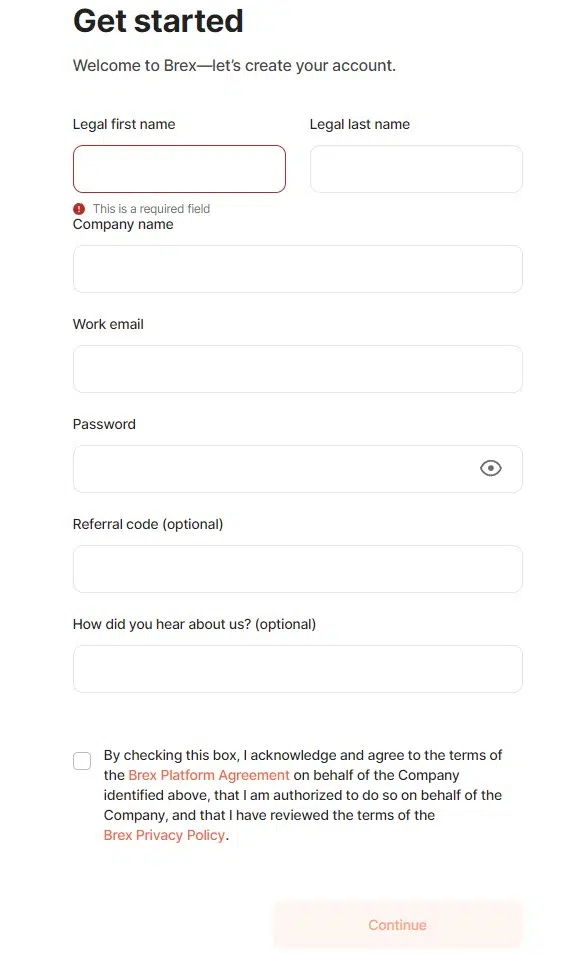

Applying for a Brex Corporate Card takes just a few minutes. Here’s how to get started:

- First, visit the website for the Brex Corporate Credit Card.

- Then click on “Open an account.”

- The application requires basic business details such as your name, work email, company role, and external funding sources.

- Then, click “Continue.”

- Brex gets your financial information when you link Brex to your business bank account.

- It also lets Brex see if your account has been linked to other business credit cards.

- You’ll get access to a virtual card if you’re approved.

- Your physical card will reach the mail in three to five business days.

FAQs

Your first five cards are free. Each additional card costs an additional $5 per month.

Your total balance is automatically deducted from your business checking account each month.

You can redeem points for statement credit through Brex’s online dashboard.