The Forgivable Equity Builder Loan is a special scheme for people under low-income groups. It is for those buyers who need extra funds to buy a house.

The calHFA loan aids lower-income people to buy with only a 10% down payment. If they stay in the home for five years, the down payment is excusable. The loan program aims to build home equity and make wealth for those who need economic help.

| Allowable First Mortgage | CalHFA Conventional, FHA, and USDA |

| Forgivable Equity Builder Loan Money | 10% of the sales price (whichever is less) |

| Income Limit | Max 80% of the AMI |

| Refund | FEBL is 100% forgiven if the borrower lives in the home for five years. 0% interest rate. The loan will be forgiven yearly pro-rated if paid off before five years. |

| Maximum CLTV | 105% |

| Extra DPA | Should not be combined with CalPLUS ZIP or MyHome Help |

What is a Forgivable Equity Builder Loan?

The California Housing Finance Agency (CalHFA) offers a new forgivable subordinate loan program called the FEBL (Forgivable Equity Loan).

This down payment assistance program was designed to boost home ownership in California by helping first-time homebuyers get immediate equity in their new home. But this program may only use with a CalHFA first mortgage.

What is the CalHFA Forgiveable Equity Builder Loan?

This new Loan CalHFA down payment assistance program has geared toward qualified buyers needing extra funds for home purchases. It has focused on lower-income individuals and families, with the <80% AMI requirement.

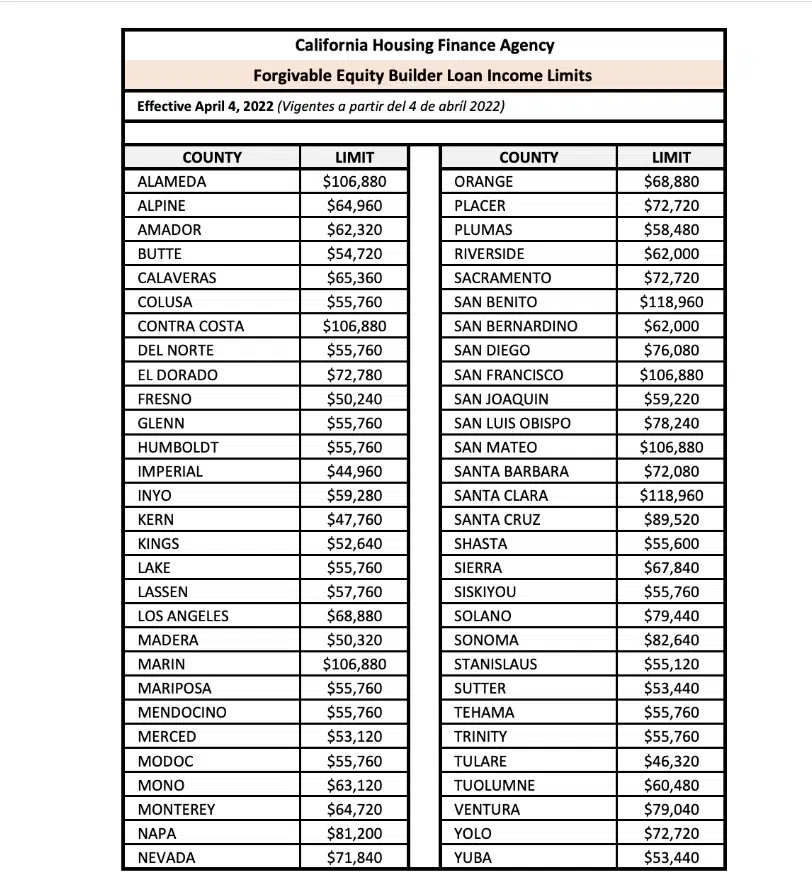

Income limits of Forgivable Equity Builder Loan

CalHFA helps low and moderate-income homebuyers realize their goal of becoming householders in California. CalHFA offers low-interest rates to housebuyers who meet the income for the County they want to buy. Borrowers are to contact an accepted CalHFA Lender for complete program information.

Income Limits

CalHFA’s income limits should not go over certain federal maximum limits. California Housing Finance Agency may set income limits below the federal limits to reach certain policy goals.

CalHFA offers low-interest rates for low to moderate-income first-time homebuyers in California. Income limits may be various for each program.

CalHFA Income Limits

- CalHFA Income Limits for All CalHFA First Mortgages and Subordinate Mortgages (effective from 07/07/2023)

Income Limits on Low Income

For Conventional and Forgivable Equity Builder Loans, only

- Fannie Mae Area Median Income Lookup Tool (effective from 06/12/2023)

- Search Archived Low-Income Limits

Maximum Federal Income Limits

For use in calculating Recapture and Loan Assumptions

- Federal Limits for Recapture and Loan Assumption (05/24/19)

Forgivable Equity Builder Loan requirements

These are the loan requirements.

Borrower: You are the borrower.

- First-time homebuyer

- Occupy the property as your primary residence.

- Complete Homebuyer Education and Counseling course (online, in-person, and virtual options are available)

- Meet county income limits set by Fannie Mae.

Property:

- Single-family, single-unit residence

- Manufactured housing is permitted.

- Condominiums may be approved if they meet the guidelines.

You should contact a qualified mortgage loan officer to determine your qualifications for this loan program.

Loan Calculator

Use this calculator to compare CalHFA loans. This tool has planned for loan authorities and lending partners. If you want to buy a home, please have your loan officer walk through this with you. This tool is for estimation purposes only. Final loan figurines may be distinct.

How To Apply For Forgivable Equity Builder Loan?

California Housing Finance Agency is not a direct lender and does not offer loans to the public. Rather, you will apply for your first mortgage and Equity Builder Loan through a network of participating private loan officers trained in this option and know how to initiate CalHFA loans.

- Your most recent pay stubs

- Bank statements

- Fully updated employment history to include your current and former jobs

- Two years of tax returns

Contact Details:

- Address: Sacramento Headquarters, 500 Capitol Mall, Ste. 1400, Sacramento, CA 95814

- Phone: 9163268033

- Email: lendertraining@calhfa.ca.gov

Conclusion

The Forgivable Equity Loan Builder program aims to help first-time buyers have a home of their own.

The Loan is a valuable tool for homebuyers who need assistance with the down payment and closing costs of purchasing a home.FEBL offers affordable and accessible financing options for low-to-moderate income.

FAQs

CalHFA will be discontinuing the Loan. This loan program will be available on November 30, 2022. All loans must be rate locked by 3 p.m. PST on November 30, 2022, or when funds become fully committed, whichever is sooner.

The Forgivable Equity Loan provides first-time homebuyers a head start on this with instant equity in their homes via a forgivable loan if the borrower constantly occupies the home as their primary residence for five years after closing.

A first-time home buyer or anyone who has yet to own property within the last three years is eligible.

Since California Housing Finance Agency is not a direct lender, our mortgage products have offer through private loan officers who have been accepted & trained.

California Housing Finance Agency (CalHFA).