If you can’t find the perfect home to buy, consider building a home instead. Financing this type of project differs from getting a mortgage to transfer into an existing property. This article will help you understand How long it takes to get a construction loan overview.

Get a construction loan.

Instead of a mortgage, you should take out a different type of construction loan. Here’s everything you need to understand about getting a construction loan, from how to work to what costs.

What is a construction loan?

A construction loan is a short-term, high-interest development that provides the funds needed to construct a residential property.

Some of the items used to cover a construction loan are:

- Cost of land

- Contractor Labour

- Building Materials

- Permissions

The loan cannot use to pay for things like household appliances.

Construction loans are typically for a one-year term. At this point, the property must construct, and an occupancy certificate must issue.

By the fourth quarter of 2022, commercial and non-commercial construction loan volume totaled $467.64 billion, according to S&P Global Market Intelligence. It is the highest level since Q2 2011.

The top five construction lenders by number of loans are (in order): Wells Fargo, U.S. Bank, Bank of America, JPMorgan Chase and Trust, and S&P reports.

Privately owned construction starts in February 2023 were 9.8 percent higher than in January, at an annualized rate of 1.45 million; U.S. Single-family authorizations for building permits rose 7.6 percent to 777,000 in February, according to the Census Bureau and HUD.

According to the National Association of Home Builders/Wells Fargo Housing Market Index, builders’ faith in the housing market fell to an eleven-year low in December 2022 but has risen every month since then. Construction loans generally require a minimum of 20 percent down.

How do construction loans work?

The construction loan process generally follows this series of steps.

A borrower applies for a construction loan and submits financials, plans, and project timelines.

The borrower draws funds for each project phase if approved, usually paying back interest only. An appraiser or inspector assesses the structure at key intervals to authorize further funding throughout construction.

After construction had completed, the borrower repays the loan or – more commonly – converts the loan to a permanent mortgage and begins repaying both principal and interest.

The initial loan term is usually the length of your construction project. Because construction loans have a very short timetable and depend on project progress, you (or your general contractor) must provide the lender with a building timeline, detailed plans, and a real budget.

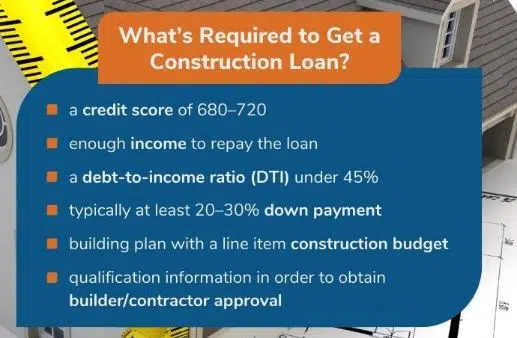

Construction Loan Requirements

Companies offering construction loans require borrowers to:

Be financially steady:

To get a construction loan, you require a low debt-to-income ratio and a way to prove enough income to repay the loan. You also generally require a credit score of at least 680.

Make a down income:

As with a mortgage, when applying for a loan, you must make a down cost: the lender won’t finance 100 percent of the project.

The amount depends on the lender you choose and the money you want to borrow to pay for construction, but construction loans typically require at least a 20 percent down payment.

Have a construction plan:

Suppose you have detailed plans and a project schedule, especially if put together by the construction business you will be working with. In that case, it will help lenders feel more confident that everything will reach according to plan and that you can repay the loan.

Get a home estimate:

The completed home is collateral for the loan, so lenders must ensure the collateral is sufficient to secure the loan. They may ask you to estimate how much the finished house would cost.

How to get a construction loan

In general, you should follow these four steps:

Find a licensed builder:

Any lender wants to know that the builder responsible for the project has the expertise to complete the home. Ask for recommendations if your family or friends have built their own homes.

You can also check the NAHB directory of local home builders associations to find contractors in your area. Just as you compare several existing homes before buying one, it’s wise to compare various builders to find the combination of cost and expertise that best suits your needs.

Get your documents together:

A lender may ask for a contract with your builder that includes detailed pricing and plans for the project. Include references to your builder and any necessary proof of their business credentials.

You’ll also need to provide many of the same financial documents you would for a traditional mortgage, such as pay stubs and tax statements that provide proof of income, assets, and employment.

Get pre-approved:

Getting it for a construction loan can provide a helpful understanding of how much you’ll be able to borrow for the project. It is an important step to avoid paying for plans from an architect or creating blueprints for a home you can’t afford.

Get Homeowners Insurance:

Even if you don’t live in the home, your lender may require a prepaid homeowner’s insurance policy that includes the builder’s risk coverage. If something happens during construction — if the half-built property catches fire or someone vandalizes it.

How long does it take to get a construction loan?

The time it brings to get a construction loan can vary depending on many factors, including the complexity of the project, the lender’s requirements, and your readiness. Here is an available timeline of the process:

Research and Prepare Documentation:

This initial step involves researching construction loan lenders and gathering documentation such as your construction plans, cost estimates, permits, and financial information.

Loan Application:

After you have prepared your documentation, you need to propose the loan application to the lender of your choice. The application process usually involves providing information about your project, financial history, and creditworthiness.

Loan review and approval:

The lender reviews your application, assesses your creditworthiness, and assesses the feasibility of your project. This step can bring several weeks, as the lender must assess the risks and potential value of the structure.

Appraisal and Underwriting:

The lender may need an inspection to determine the property’s value after construction. Additionally, they conduct underwriting, which involves assessing your financial ability to repay the loan. This stage may take a few weeks.

Closing and Disbursement:

If your application for a construction loan had been approved, you would have gone on to the closing step to sign the necessary paperwork. Following closing, monies are typically disbursed by your loan agreement’s specified series of draws or phases.

Getting a construction loan can take many weeks to a few months. Starting the process early when you plan to start construction is necessary to allow for any potential delays or complications.

Remember that this timeline is a general guideline, and the actual timeframe may vary based on individual circumstances and specific lender processes.

FAQs

The maximum loan tenure for construction loans is 10-15 years.

The loan amount is disbursed in installments only. Unlike home purchase loans, where the lender pays the entire amount in one lump sum, for construction home loans, the amount is disbursed only in installments. The sanctioned loan amount will disburse in phases depending on the construction progress.

Under construction, home loans are disbursed in installments as they are given based on the construction stage of the property. Here, interest had charged only on the amount paid, meaning the borrower has lower EMI amounts.

A type of loan where the entire loan amount had been disbursed to the borrower at once; he buys an existing house and starts paying EMIs over 20 to 30 years—a type of loan in which the loan amount is disbursed in stages for home construction.