There are certain steps to transfer money from Virtual cards to a bank account. This article will give you the steps and ways to transfer money. Information about the card, its advantages, uses, etc., are given in this article.

What are Virtual cards?

Virtual cards are temporary card that has a certain expiration date. These are the digital version of physical debit and credit cards provided through mobile apps. All the original card details are on this but in digital form. Only certain merchants accept payments from this method.

- Cardholder’s name.

- CVV number.

- 16-digit card number.

- Expiry date.

- Transaction settings.

Account holders can use this card through mobile apps for online shopping. It is not a physical card, so you cannot use it for swiping, physical transactions, or ATM withdrawals.

Benefits:

Here are some benefits of Virtual cards provided by banks. They are,

- It is very fast and easy to use. Your data is secured and cannot be stolen.

- You don’t need to go to ATMs to activate this card, as you can activate it online.

- Users can block the card at any time if they suspect any fraud.

- Many offers are given to the cardholder.

- Users can set the card limit.

- Payments are easy using this service.

How to transfer money from Virtual cards to a bank account?

While requesting virtual cards, you have to link a bank account. As it is already linked, go to the app and transfer the amount to another bank account. You can also transfer using e-wallets. You must link the virtual card to Paypal or any e-wallet to transfer funds.

For virtual credit cards, you cannot transfer an amount; you can use it only while shopping online. So, you can link the card to Paypal to transfer money. Here are the steps to transfer money using Paypal.

Steps:

- Open the Paypal app and open your account.

- Go to the Transfer money and payments option and click on it.

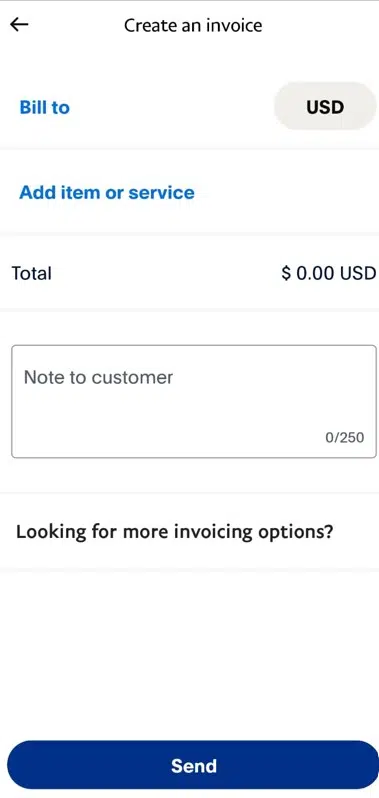

- Now, select Create invoice. And click on the +create icon.

- Next, enter the email id that is not linked with your Paypal account.

- Enter the amount and click on Send option.

- You will get a mail, select the View invoice and pay option.

- After that, on the top left, you will see the Pay xxxEur option. Click on it.

- Select either Pay as a guest or pay with a Credit card option.

- Enter all the details and click on No thanks

- Under that, tap on the Select conversion option, and you will get a pop-up as Pay in the merchant’s currency. Click on it.

- Finally, transfer money from Paypal to your other bank account after payments.

Who uses Virtual cards mostly?

Virtual cards, like credit and debit cards, are provided by banks and are mostly used by business people. They use this to secure their details and to prevent fraud. Most of them use it for online purchases. They also use it because it helps to eliminate the need for draft checks. You can add the amount to your virtual card if you find a low balance.

Frequently asked questions (FAQs):

You can use a virtual card to make online payments easily.

It is only one-time use. So they are valid for up to 48 hours.

Yes, we can use this card at ATMs. For that, we need a digital wallet and a PIN code.

Some banks add charges on a Virtual card and a monthly fee.