Are you using Paytm Postpaid? It is a valuable service. But there are rules like you cannot transfer Paytm postpaid money to a bank account. Do you know if transferring money from Paytm Postpaid to Paytm Wallet or transferring Paytm Postpaid funds to a bank account is feasible? Yes, we can do it in a few simple steps.

Transfer Paytm postpaid money to a bank account:

As you know, Paytm can use postpaid for mobile recharge, movie tickets, shopping, etc. Along with that, you can use your credit to pay Paytm Business accounts as well. You need a business account to transfer money from Paytm Postpaid to Paytm Wallet.

However, you cannot transfer money to your business account. You are required to create a business account for a household member or friend.

What is Paytm Postpaid?

Paytm has launched a credit service for select users where they can spend money and pay it back later. Similar to Paytm postpaid credit cards. The service permits users to book movie tickets, recharge and shop on Paytm.

Any user can access this service through the Paytm app. The user must repay the amount spent by the seventh day of the month to avoid any penalty or late fee. Depending on the consumer’s credit score, a monthly limit is assigned, and we can use that for various payments.

Paytm Postpaid is available in three variants – Lite, Delight and Elite. The monthly limit for Lite is 20,000 rupees. Paytm also charges a convenience fee on the user’s monthly bill.

Paytm Postpaid Eligibility:

Activation of Paytm Postpaid is entirely online without the need to visit a Paytm Postpaid-eligible branch. The credit limitation is decided based on the user’s transaction history on Paytm.

The limitation increases depending on the use of the service. Your Paytm Postpaid limit is Rs. 100,000, be. Paytm postpaid users can convert their outstanding amount into monthly EMIs.

The convenience fee ranges from 0 to 4 per cent depending on the monthly spending of the users. The service allows users to pay at neighbourhood Kirana stores. There is also an option to make onsite utility payments and online transactions like Domino’s, Pepperfry, and Tata Sky.

Accepting payment utilizing Paytm Postpaid is available only to select merchants. Although you can transfer money from Paytm Postpaid to your wallet, repay the outstanding amount; otherwise, additional charges will apply.

Paytm Postpaid Features:

- Instant money.

- No fees & charges

- No documents needed

- No documents are required.

- Aadhar verified Paytm Account.

- ICICI bank account is linked with the same Paytm number.

So, let’s quickly transfer postpaid money to a bank account. We need some real cash on hand for emergencies, and if you don’t have bank cash, move the postpaid balance to your bank account by following the below steps.

How to Activate Paytm Postpaid?

- Login to the Paytm app.

- Locate the Paytm Postpaid banner.

- Click on the banner.

- Tap on “Activate My Paytm Postpaid”.

- Enter the PAN number.

- Submit your Paytm Postpaid application online.

- Complete! Your Paytm Postpaid account has been activated.

How to transfer Paytm postpaid money to a bank account?

- First, open the Paytm app.

- Then click on the PAY option.

- Then, scan your own/friend’s Paytm merchant barcode.

- Then, pay the amount using the Paytm Postpaid balance option.

- Hooray, the payment was successfully credited to the merchant account.

- Then, you will successfully transfer this amount to the Paytm merchant bank account.

- Now, you can withdraw money from your bank account or cash from your friend using your friend’s Paytm merchant barcode.

Transfer Paytm Postpaid Balance to Bank Account via Zingoy:

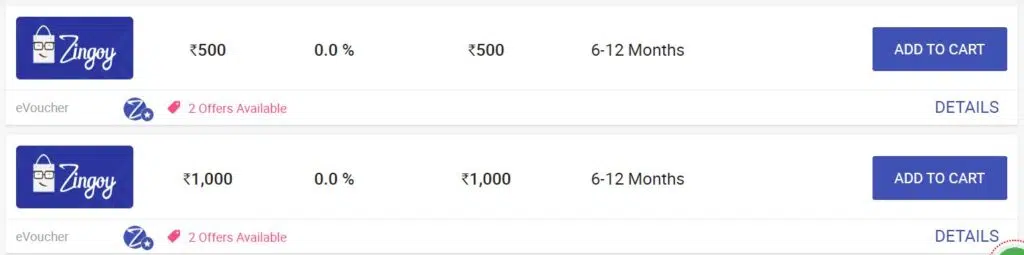

- First, Open the Zingoy Website or App.

- Create New Account

- Then Click on the Zingoy Search Option and search for Zingoy Gift Card.

- Select Any Amount Gift Card.

- Add to the Cart and buy it.

- Finally, Select the Payment Method as PayTM

- Login to your Paytm Account and uncheck All Options. Tick on Postpaid.

- Finally, Make a Payment

- You will receive a Zingoy Gift Card Instantly on Notification Options.

- Copy Gift Card & PIN

- All done! You will get Zingoy Voucher.

- Using this voucher, you can buy a Paytm Ad Money Voucher and transfer your money to your bank account.

- Enjoy the trick

Paytm Postpaid charges:

| Outstanding Amount | Late Fees (per month) |

| Up to Rs. 100 | Rs.0 |

| Rs.101 to Rs.250 | Rs.10 |

| Rs.251 to Rs.500 | Rs.25 |

| Rs.501 to Rs.1000 | Rs.50 |

| Rs.1001 to Rs.2000 | Rs.100 |

| Rs.2001 to Rs.5000 | Rs.250 |

| Rs.5001 and above | Rs.500 |

Terms & Conditions:

- The maximum amount transferred in a month is Rs 10000.

- Paytm reserves the right to close this offer without any prior notification.

- This offer trick is valid in some good states.

- This trick takes 5 minutes of activation time.

- Any misuse of the offer reserves the right to take legal action against a particular.

- We are not responsible if this trick doesn’t work in your state.

- Before activating this offer, make sure that this offer works in your state.

- The origin of this offer is Paytm.

- Users must read the complete article to get the activation code because every point is important.

Conclusion:

Readers, here we are giving you a step-by-step process to transfer Paytm postpaid money to a bank account.

To activate this offer, read the article carefully and follow the steps provided. Users can avail of this offer very quickly.

If you have any problems while activating this offer, you can ask us in the comment box, and we will surely solve your problem.

FAQs:

You can get free Paytm cashback by using promo codes while purchasing on the Paytm app. Tap ‘Cash Back’ in the top right corner of your Paytm app to find regular promo codes and deals. By ordering a gift voucher from Paytm, you will get extra cashback.

You can register with your mobile number and email address on the Paytm app. You must complete full KYC to load more than Rs. 10,000 in your Paytm wallet. With a basic account, you can make mobile recharges, bill payments, shop online, and use other facilities.

Activate Paytm Postpaid from the Paytm app. You can find the choice in the app’s Loans & Credit Card section. Enter your PAN Number & DOB to check your credit limit for Paytm Postpaid.

Eligibility for Paytm Postpaid depends on your credit score. You can check eligibility from the Paytm app. Enter your PAN number and birth date to check this service’s eligibility.

Yes, Paytm has launched a revamped version of its credit service. You can check eligibility and your credit limit from the Paytm app.