You all know that Paytm launched its Paytm BC Point Agent to digitalize India and help the Indian government access financial services. There will be a lot of help, and they can take advantage of their banking services from home.

Paytm BC Point Agent

Paytm Payments Bank CSP provides financial services in its remote cities, where all customers have bank-like facilities. You can also open your account and get interested in rural areas where people need help to open their accounts.

Now because of this, they will be able to do their digital transactions very easily, thus benefiting them greatly. Let’s know how you can become a Paytm Payments Bank BC agent and the qualifications.

What is Paytm Payment Bank?

Paytm Payments Bank provides its services easily across India. Let us inform you that this small-scale bank is called Payments Bank. Many companies in India have obtained a payments bank license, which the Reserve Bank of India issues.

Paytm Payments Bank works like any other bank, but the work of payments banks is to do digital transactions. They do all their work in digital form. So, the payment bank maximum transaction is only up to ₹ 100000.

Similarly, Paytm Payment Bank also operates in this region and provides all its services to the people. Paytm Payments Bank had licensed as an authorized bank enabled by the Reserve Bank of India.

If you also join Paytm Payments Bank, then by joining it, you can also arrange your job if Paytm Payments Bank. If you want to open your own savings account, here you can open your account digitally only through your mobile.

Paytm Payments Bank also offers franchisees through which you can easily connect with rural areas and take this franchise to the people of your rural town by taking Paytm Payments Bank Franchise.

Paytm Payments Bank’s mission is to digitally enable all villages so that you can do maximum transactions digitally. Below we will tell you how to open Paytm Payments Bank and what information it contains.

Paytm Payment Bank BC Point agent benefits

You will get the following benefits if you become a Paytm Payment Bank BC agent.

- You can open bank accounts at your store after becoming a Paytm Bank BC Point agent.

- Paytm bank account is free to open.

- After opening this Paytm Payment Bank Account, you can also provide an ATM card to the customer.

- A customer can come to you and deposit and withdraw the amount in his Paytm Payment Bank account.

- You will be paid the best commission on every deposit and withdrawal.

- After opening a Paytm Payment Bank Account, you will be paid a commission from Paytm.

- You can open this Paytm Payment Bank account with a thumb swipe and no bank-related paperwork.

- After evolving into a Paytm Payment Bank BC agent, the customer can also get a chequebook after opening an account with you.

- After you deposit cash in Paytm Payment Bank, customers had also given interest on it.

Paytm Payments Bank BC point Agent Apply

You can become a Paytm Payments Bank BC Point agent in two ways. The first way to become a Paytm Payment Bank BC agent is by contacting your nearest Paytm official. It will provide complete information and make you a Paytm Payments Bank CSP agent.

And you can become a Paytm BC agent by applying online and contacting the Paytm payment bank officer in your area under two conditions. You can only make your Paytm payment through Paytm Bank Paytm Officer.

We are going to tell you two ways below. You can open Paytm Payment Bank by any method.

Paytm BC Point Agent Document Required:

To become a Paytm Payment Bank Csp, you must have the following documents; otherwise. So you need to collect all these documents because when you become a paying bank BC agent, you will ask for these documents.

- Email ID

- Pan Card

- Mobile Number

- Passport Size Photo

- Aadhar Card

- Inside Shop Photo

- Photo Outside The Store

How to Apply Online for Paytm BC Point Agent?

To become a Paytm Bank BC agent, follow the procedure below.

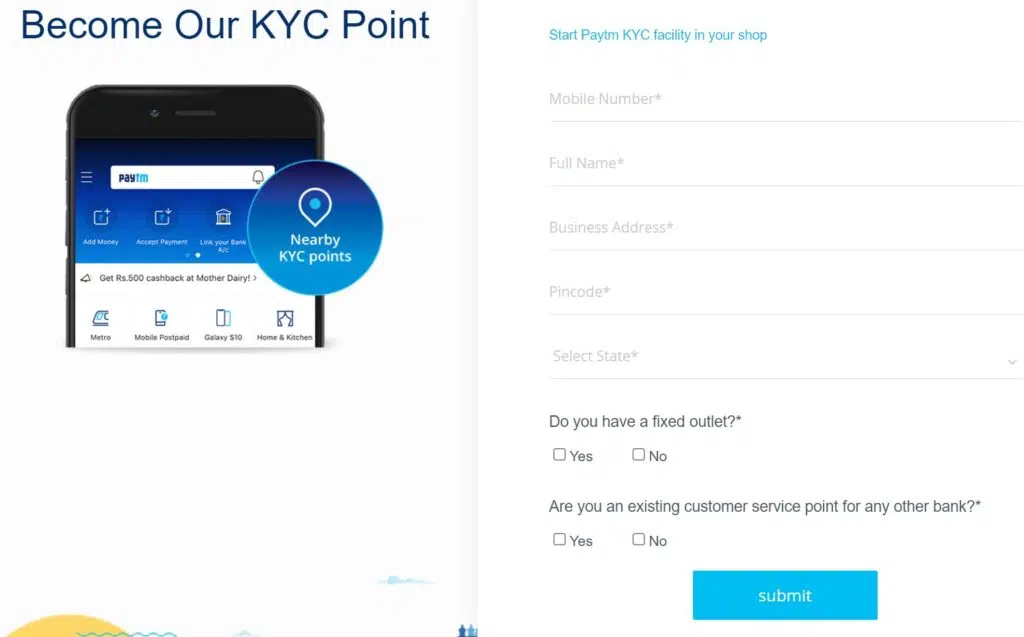

- First, go to the official website of Paytm Payment Bank to apply.

- After successfully opening Paytm Payment Bank’s official website, the application form will open before you.

- Carefully read the complete information asked in the Paytm Payment Bank application form.

- Now you have to fill in the following information in this application form.

- First, enter your registered mobile number.

- Now fill in your full name.

- Now you fill in your complete address here.

- After, you enter your pin code here.

- Then After entering the pin code, select your state.

- After this, you will ask if you already have an outlet or shop, then click on it or click on it.

- Below it asks if you already have a banking centre. If you do, check YES, and if not, NO.

- Now you have to click on submit button here.

- They will complete your online registration for Paytm Payment Bank BC Agent by clicking the submit button.

- You will receive a call from Paytm on your given mobile number, where your verification will be done.

- After complete verification, you will become a Paytm Payment Bank BC agent and give your user ID password.

Who can be a Paytm BC Point Agent?

If you also want to come and know the eligibility to start Paytm Payment Bank assistance, we will provide you with the complete information below.

- To open Paytm Payment Bank, you must have a shop or outlet.

- To become Paytm Payment Bank BC Agent, you need a 12th pass.

- To become this Paytm Bank BC agent, you must know about computers.

- To open Paytm Payment Bank, you need a smartphone and a laptop.

- You must have one fingerprint device to become a Paytm Payment Bank BC agent.

- To become a Paytm Payment Bank BC agent, you must know about banking-related services.

How to Login to Paytm BC Agent?

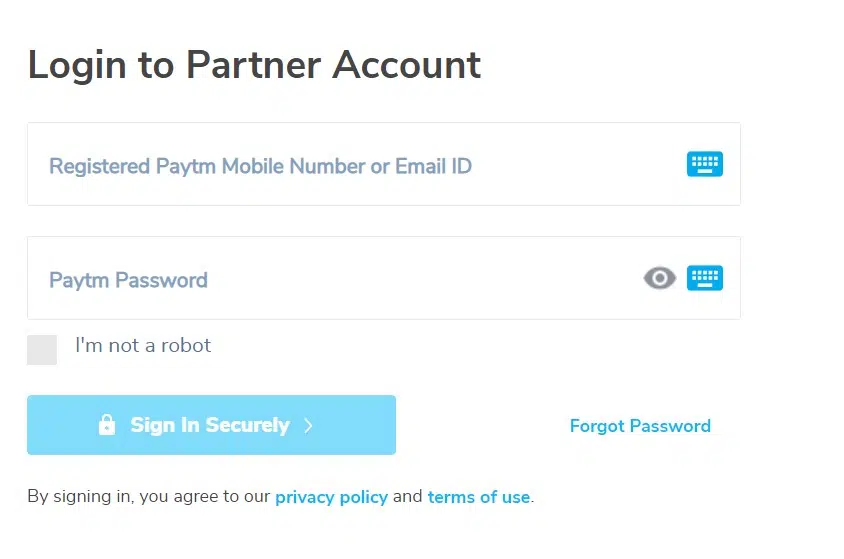

Follow the below procedure to log in to Paytm Payment Bank BC Agent.

- To log in as Paytm Payment Bank BC Point Agent, visit the official website by clicking here.

- After successfully opening the website, you need to click on the login button.

- After clicking on login successfully, the login page will appear in front of you.

- You need to enter your Paytm BC Agent Login ID and Password here.

- After entering the login id and password, click on the login button.

- After successful login to the Paytm BC agent, you will see its interface. Now you can avail of all the services of Paytm Payment Bank to your customers from here.

Earn money by installing Paytm ATM BC Point Agent app.

To install Paytm Payment Bank ATM service, follow the below procedure

- First, you need to become a Paytm Payment Bank BC agent.

- As soon as you become a Paytm Bank BC agent, you will be offered payment bank service by Paytm.

- Paytm KA ATM service is provided to you in Paytm Payment Bank Service.

- You can deposit and withdraw your customer’s money with the help of this PAYTM KA ATM service.

- Any customer near you can open a bank account, and when you come to withdraw money, you can withdraw it.

- Here you will be given a good commission for depositing and withdrawing money.

For more information about the service of PAYTM KA ATM, you can get it by visiting the official website of Paytm Benefits of Paytm Bank BC Agent.

Paytm BC point customer care number

You can call Paytm on their 24X7 helpline number: 0120-4456-456 to help resolve your queries.

FAQs

As soon as you become a Paytm Bank BC Point agent, you will be offered payment bank service by Paytm.

Paytm supports instant refunds on debit/credit cards, net banking, and UPI within a minute or two of launch. Refunds for orders paid through Paytm Wallet and Paytm Postpaid are always, by default, immediate and in a relevant manner.

Business correspondents are retail dealers banks engage to provide banking services at places other than bank branches/ATMs.

Know Your Customer (KYC) standards had designed to protect financial institutions from fraud, corruption, money laundering, and terrorist financing.