A cheque written on a cheque dated before the date of presentation to the bank is called an Ante-dated cheque. Any post-dated cheque (not exceeding the last three months) can be presented to the bank for clearance or payment.

Details about Ante-dated cheque

For example, a cheque dated 13 August can pay 2018 for an account opened on 28 August 2018. Ante-dated cheque means a cheque dated before today or backdated, and a cheque presented at the bank had an unexpired cheque that can be deposited in the bank account anytime up to three months from the date of the cheque.

These types of cheques have an encashed date. Even if the bearer offers this cheque to the bank immediately after receiving it, the bank will process the payment as the date mentioned in the cheque has been backdated. This cheque is valid if three months have stayed on the presentation date.

How can you identify an Ante-dated cheque?

You can identify a cheque as an anti-dated cheque when you see the date on the cheque is backdated and does not have a current date.

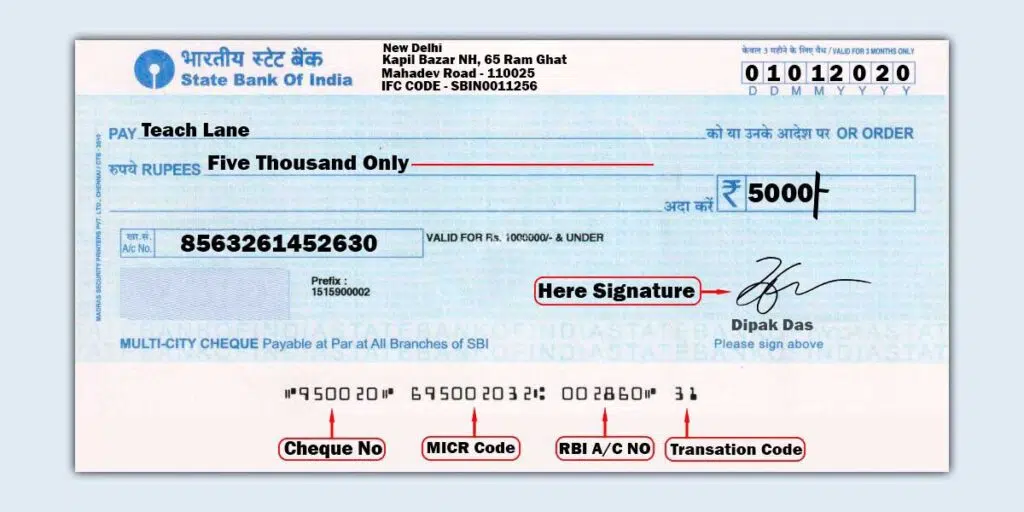

For example – by taking the image shown above, suppose today’s date is 15/10/2023, but the cheque is dated 11/09/2023. Then, it is called an ante-dated cheque. This cheque is valid for three months, starting 11.09.2023.

What are the features of an Anti-dated cheque?

These feature ante-dated cheques-

- It is a negotiable instrument.

- You can encash it within three months’ validity from the cheque date.

- The cheque can be any cheque. You need help seeing the current date.

- It will live backdated.

- This cheque can clear on the date or up to 3 months later.

- If you have yet to deposit a current dated cheque today, it could be used as a previous cheque.

How do you fill an ante-dated cheque?

These are the steps to fill an ante-dated cheque-

- First, take a new cheque.

- Then, you can enter the date on the back in the upper right corner.

- Then, enter the name of the recipient.

- Now, fill in the sum in numbers.

- Then, write the sum in words.

- Then, sign the cheque.

- And ensure that if the word ‘or bearer’ is written, it is not a bearer cheque. You should strike it out as this “or bearer.”

- Then, cross the top left corner or anywhere on the cheque with two parallel lines.

- The word “A/c Payee” must be written between two parallel lines.

Who can withdraw the Ante-dated cheque?

The person named on the cheque means the payee or any third person authorized or endorsed to cash or deposit the cheque in his account by filling out the deposit slip.

It depends on the following type of pre-dated cheque, like bearer, order, crossed or account payee, etc., and submit it within three months from the cheque date.

Other types of cheques

These are the types of cheques that can be seen according to the Negotiable Instrument Act-

- Ante-Dated Cheque

- Post Dated Cheque

- Stale Cheque

- Blank Cheque

- Order Cheque

- Crossed Cheque

- Bearer Cheque

- Open Cheque

- Cancelled cheque

- Self Cheque

- Traveller’s cheque

- Bankers Cheque

- Gift cheque

- At par cheque

- Local Cheque

- Normal Value Cheque

- High-Value Cheque

- Outstation Cheque

Some of them are discussed below.

Post-dated cheque:

When the cheque is bearing post-dated, or put, it is a post-dated cheque. If a cheque is dated next week or next month, it is called a post-dated cheque. A post-dated cheque can only be present at the bank for clearance on or after that date.

This type of cheque was issued when the person issuing the cheque had a low balance in the account but had committed to any future payment by either party.

Stale cheque:

As you know, the validity of the cheque is three months from the date of the cheque. When the validity period ends, the cheque becomes stale. Such a cheque cannot be present for payment at the bank.

And if they presented for payment, they got shame from the bank. Banks also do not accept these cheques. So it is about the old, post-dated, and old cheques. We hope you found this article informative and useful.

Blank Cheque:

A blank cheque is a cheque that has yet to be filled. A blank cheque may or may not have the date and name of the payee. It can be done as Payee A/c. You can sign a cheque without a specified name, and the total limit can also be defined. Giving a black cheque for the amount is very risky.

Order Cheque:

In these cheques, the words ‘or bearer’ had been cancelled. Such cheques are issued only to someone named on the cheque, and the bank does its background cheque to authenticate the identity of the cheque bearer before releasing the payment.

Crossed cheque:

You may have noticed cheques with two slanting horizontal lines with the words’ a/c payee’ written at the top left of the crossed cheque.

That is a crossed cheque. Whoever presents the cheque, payment is made only to the person whose name is written on the cheque. In other words, only to the a/c payee and their account number. These cheques are relatively safe as they are encashed only at the drawee bank.

FAQs

Yes, if it passes, you can secure the a/c cheque because account payee cheques are deposited only in the named person’s account. And it is not cached.

If it is the bearer’s cheque, you can withdraw cash, i.e., the cheque holder can present it to the bank for encashment.

A cheque is a post-dated cheque if it bears any backdate. This cheque is used on the cheque date or after the cheque date.

Signing on the back of the cheque is not mandatory. But if it is self-chequered or endorsed, a signature is required on the reverse side of the cheque.