BOB(Bank of Baroda) Easy Credit Card is one of the primary credit cards offered by the Bank of Baroda. This Bank of Baroda credit card fits low-income people as it offers rapid rewards and cashback offers on common spending categories.

BOB Easy Credit Card:

By achieving the milestones set by the BOB, cardholders can avail of the Joining Fee Reversal and Annual Fee Exemption facility.

Below are all the features and benefits that BOB Easy Credit Card offers. Do not forget to check the various fees related to using the card, eligibility to apply for a credit card required documents and the process of applying for the card.

Benefits and Features of BOB Easy Credit Card:

- Get 1 Reward Point for every Rs.100 spent on the card.

- Five more rewards for every Rs 100 spent on groceries, department stores and movies.

- You can redeem reward points for cash back and other exciting gifts and vouchers.

- Pay your easy credit card bill on time and get 0.5% cash back on the bill amount in the following statement.

- Annual fee waiver for spending Rs 6,000 in the first 60 days of credit card and Rs 35,000 a year.

- A 1% fuel surcharge exemption is valid at all petrol stations across India for a minimum transaction amount of Rs.400 and a maximum amount of Rs.5,000.

- Convert purchases over Rs 2,500 into easy monthly instalments (EMIs) and repay within 6 or 12 months.

- Basic cardholder family members, including spouses, parents, siblings and children over 18, can obtain three add-on credit cards with free personal accident death insurance.

- If you had reported the loss within 24 hours of the incident, there would be zero liability on the lost card for an interest-free period of up to 50 days.

- A revolving credit facility is available upon payment of the minimum amount due.

BOB Credit Card Reward Points & Cashback:

All credit cards offered by BoB Financial come with excellent reward rates. Some cards offer reward points, while others offer cash back or miles for expenses. Most BoB credit cards offer reward points to their customers.

Different cards may have different reward rates, and the number of reward points may vary by category. Cards with a lower annual fee usually offer a lower reward rate than cards with a higher yearly fee.

Charges BOB Easy Credit Card:

| Fee Type | Amount |

| First-year fee | 500 RS |

| Annual fee | 500 RS |

| Cash withdrawal fees (Domestic ATMs) | 2.5% of the transaction payment subject to a minimum of Rs.300 |

| Cash withdrawal fees (International ATMs) | 3.0% of the transaction payment subject to a minimum of Rs.300 |

| Finance charges or interests | 3.25% per month or 39% per year |

| Duplicate bill fees | Rs.25 per request |

| Cheque return charge | 2% of the cheque amount or 300 RS, whichever is more increased |

| Over limit charge | 1% if the usage exceeds the authorised credit limit per month |

| Card replacement charge | Rs.100 per request |

| Foreign currency transaction fees | 3.5% of the transaction amount |

| Charge slip retrieval charges | Rs.250 per slip |

| Card de-blocking charges | Rs.300 per instance |

| Late payment charge |

|

Eligibility:

- For eligible private employees to apply for the BOB Easy Credit Card, Gross Income per annum should be Rs—three lakhs or more.

- For companies and private companies, Payment Capital should be Rs. 25 lakhs or more.

Required Documents to apply for BOB Easy Credit Card:

- For Private Employees – Private Account with BOB, Latest Form 16 or ITR Copy.

- For Self Employment – All three-year audited balance sheet, Profit and Loss Account

- Applicants must submit a photograph, proof of identity and proof of address.

How do you apply for BOB Easy Credit Cards?

You can apply for Bank of Baroda Credit Cards by visiting your nearest BoB branch or through the official website of BoB Financial as follows:

- Visit the Bank of Baroda’s Official Website

- Select the credit card you want to apply for, like Easy Credit Card.

- Click on the ‘Apply Now’ option.

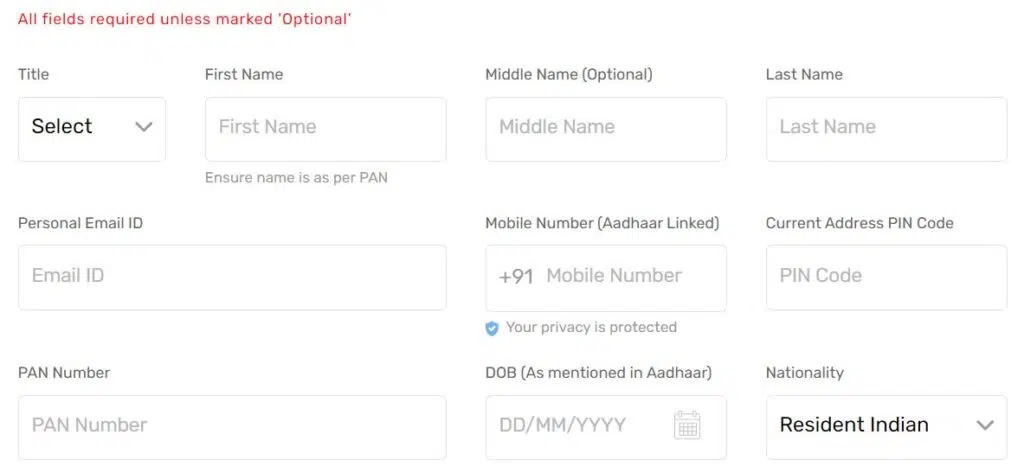

- You will be redirected to the application form.

- Carefully fill in all the required details and check them out before proceeding.

- Complete all the formalities as per the website instructions.

Track Application Status:

- To track the status of your credit card application, go to this link.

- Enter your application number and click on ‘Get Details’.

- You get the status of your application on your Screen.

How do you activate the BOB Easy Credit Card?

- After receiving your new credit card from BoB Financial, activating it is your first step. There are many online and offline methods to activate your credit card, some of which are as follows:

- You can activate your credit card through Internet banking. Log in to your Net Banking Account and find the Activation/PIN Generation option from the menu.

- Another way to activate your credit card is through an ATM. Visit your nearest BoB ATM, insert your credit card and select the option to activate your card from the main menu.

BOB Easy Credit Card Login/Net Banking:

Nowadays, everyone wants to complete their banking-related tasks from the comfort of their home. Hence, many banks and card issuers have started offering Internet banking facilities. You can also get excellent services by registering your Bob credit card for Net Banking.

There are a few steps to do the same:

- Visit the BoB Financial Net Banking page.

- Click on the signup option.

- Enter all the required details, including your credit card number, expiration date and other information needed, and click ‘Proceed’.

Credit Card Customer Care:

BoB Financial Services offers limited value to its customers and, therefore, provides 24*7 assistance & support to them.

You can contact 1800-103-1006 or 1800-225-100 for the following services:

- To block your card

- Balance inquiry

- PIN generation

- To know your card status

FAQs:

Bank of Baroda has a minimum CIBIL score requirement of 750 for issuing a credit card.

BOB Financial offers all new credit cards (except Eterna) as Life Time Free (LTF) and will apply to Easy, Select, Premier and Corporate Cards. In LTF, only the annual fee & joining fee is waived, and all other charges are applicable as per the MITC booklet.

The applicant should be at least 18 years old and a maximum of 65 years. Anyone under this age limit can apply for a credit card with the Bank of Baroda. The add-on credit cardholder should be 18 years old and above.

EMI Option: Convert purchases over Rs. 2,500 on the card into EMIs of 6 to 12 months of tenure. Free Add-on Cards – 3 free add-on cards for immediate family members above 18. Interest-Free Period – Up to 50 days of interest-free period on purchases.

BOB Financial offers all new credit cards (except Eterna) as Life Time Free (LTF) and will apply to Easy, Select, Premier and Corporate Cards. In LTF, only the annual fee & joining fee are waived, and all other charges are applicable as per the MITC booklet.