BOB Premier Credit Card Financial has issued the Bank of Baroda Premier Credit Card to offer multiple benefits to its customers at low rates. It comes with zero joining and an annual fee.

About the BOB Premier Credit Card:

You can get a maximum of 10 reward points for every Rs 100 You spend using this card and redeem these points against various options, including cash credit.

In addition, you get complimentary access to selected airport lounges in India every calendar quarter. Previously, the annual fee for the card was Rs. 1,000, issued by its issuer to provide significant benefits to its customers at no cost.

Other card benefits include fuel surcharge exemption, personal accident insurance, etc. To learn more about the Bank of Baroda Premier Credit Card, read the full article:

BOB Premier Credit Card Features and Benefits:

Reward Points Program:

- Get 1 Reward Point for every Rs.100 spent on all categories.

- 5X more rewards on travel, meals and international expenses.

- Redeem Reward Points for Cashback or other exciting gifts and vouchers.

Exclusive Premier Privileges:

- Free access to over 35 airport lounges in 22 Indian cities and 24×7 Concierge assistance to cardholders.

Annual Fee Exemption:

Spend Rs.10,000 in the first 60 days of credit card and Rs.1.2 lakh annually for annual fee reversal.

- Easy EMI: Any card purchases over Rs 2,500 can be converted into easy monthly instalments (EMIs) and refunded over 6 or 12 months.

- Lifetime-free add-on cards: Cardholders can get three add-on credit cards with the same benefits as the primary card. Add-on cards were provided free of charge for life. Add-on cards are available for spouses, parents, siblings and children over 18.

- Complimentary Insurance Cover: BOB Premier Credit Card provides personal accident death insurance coverage to protect cardholder and their family financially. Insurance is provided free of charge.

- Zero Liability on Lost Card: Report BOB Premier Credit Card Loss within 24 hours and be 0% liable for any fraudulent transactions after that.

- Other Features: A credit card offers an interest-free period of up to 50 days. A revolving credit facility is available upon payment of the minimum amount due.

Bank of Baroda Premier Credit Card Fees:

| Fee Type | Amount |

| First-year fee | 1,000 RS |

| Annual fee | 1,000 RS |

| Cash withdrawal fees (Domestic ATMs) | 2.5% of the transaction amount subject to a minimum of Rs.300 |

| Cash withdrawal fees (International ATMs) | 3.0% of the transaction amount subject to a minimum of Rs.300 |

| Finance charges or interests | 3.25% per month or 39% per annum |

| Duplicate bill fees | Rs.25 per request |

| Cheque return charge | 2% of the cheque amount or Rs.300, whichever is higher |

| Over limit charge | 1% if the usage exceeds the sanctioned credit limit per month |

| Card replacement charge | Rs.100 per request |

| Foreign currency transaction fees | 3.5% of the transaction amount |

| Charge slip retrieval charge | Rs.250 per slip |

| Card de-blocking charge | Rs.300 per instance |

| Late payment charge |

|

Eligibility Criteria:

- For eligible salary to apply for the Bank of Baroda Premier Credit Card, Gross Income should be Rs—three lakhs per annum.

- For companies and private companies, Payment Capital should be Rs. 25 lakhs or more.

Documents required to apply for BOB Premier Credit Card:

For Salaried:

- Copy of personal account with BOB

- latest form 16 or ITR copy

- Proof of address

- Copy of identity card, and,

- photograph

For self-employed:

- The last three years’ audited balance sheet

- Profit and loss account

- Address proof copy

- Identity card copy and

- A photograph

Bank of Baroda Premier Credit Card Rewards:

- You get ten reward points for every Rs 100 you spend on travel, meals and overseas expenses

- You will get two reward points for every Rs 100 you spend on all categories.

- You get a 0.5% reward rate on all other types.

- 5x reward points on travel, meals and overseas expenses are limited to 2,000 monthly reward points.

- No reward points were earned on fuel transactions.

How do you apply for BoB Premier Credit Cards?

You can apply for Bank of Baroda Credit Cards by visiting your nearest BoB branch or through the official website of BoB Financial as follows:

- Visit the Bank of Baroda’s Official Website.

- Select the credit card you want to apply for, like Premier Credit Card.

- Click on the ‘Apply Now’ option.

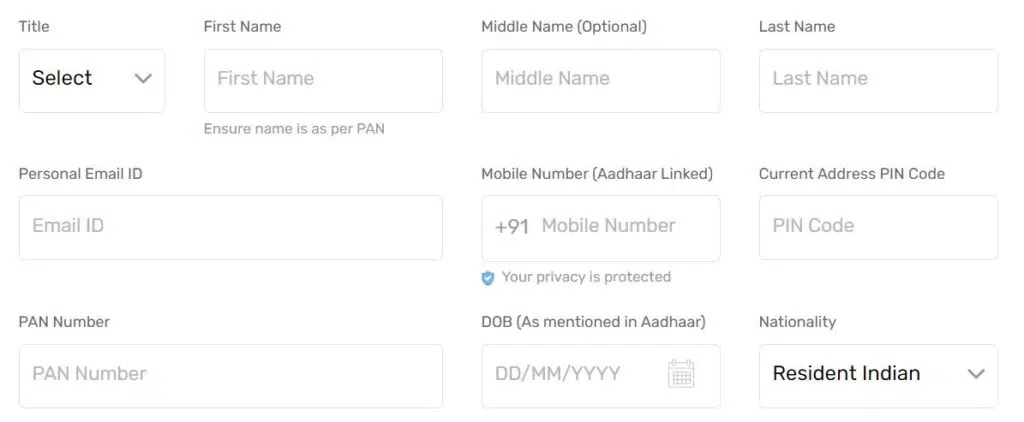

- You will be redirected to the application form.

- Carefully fill in all the required details and check them out before proceeding.

- Complete all the formalities as per the website instructions.

Track Application Status:

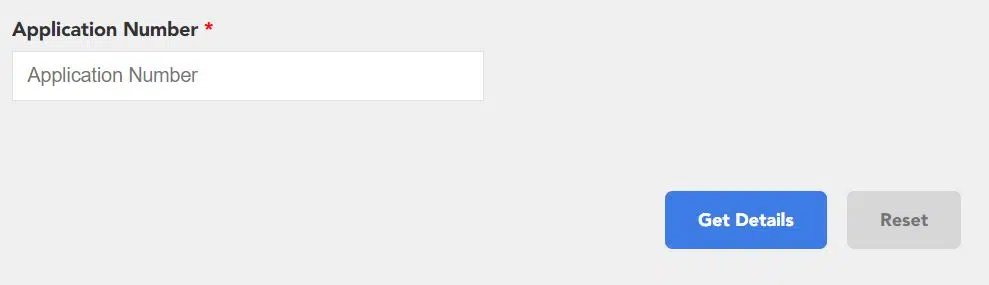

- To track the status of your credit card application through the official website.

- Enter your application number and click on ‘Get Details’.

- You get the status of your application on your Screen.

How do you activate the BOB Premier Credit Card?

After receiving your new credit card from BoB Financial, activating it is your first step. There are many online and offline methods to activate your credit card, some of which are as follows:

You can activate your credit card through Internet banking. Log in to your Net Banking Account and find the Activation/PIN Generation option from the menu. Another way to activate your credit card is through an ATM.

Visit your nearest BoB ATM, insert your credit card and select the option to activate your card from the main menu. You can also contact your customer care and ask them to assist you in starting your credit card.

Bank of Baroda Credit Card Login:

Bank of Baroda Credit Card Holders can log in to their credit card accounts.

- Visit https://www.bobfinancial.com.

- If you have a retail account, select “Retail Customer.”

- If you are a corporate at Bank of Baroda If you have an account, select “Corporate User”.

- Once you have selected any user, you will be redirected to the login page.

- Enter your username

- Enter your password to log in successfully.

- Make sure you have created a Net Banking account before logging in.

BOB Credit Card Customer Care:

BoB Financial Services offers limited value to its customers and, therefore, provides 24*7 assistance & support to them.

You can contact 1800-103-1006 or 1800-225-100 for the following services:

- To block your card

- Balance inquiry

- PIN generation

- To know your card status

You can also avail of the BoB SMS service number 9223172141. send an SMS to this number as follows:

- To block your lost/stolen card – SMS BLOCK XXXX

- For Balance Inquiry – SMS BAL XXXX

- To Receive Summary of Reward Points – SMS Reward XXXX to Summary of Your Last Statement – XATX SMS

- To find out the last payment details, Click Payment XXXX.

(Here, XXXX is the last four digits of your credit card number).

FAQs:

Yes, the facility of revolving credit is available.

The BOB Premier Bankcard Mastercard is an unsecured card for people who want to establish or rebuild their credit. But the trade-off for not putting down a security deposit is multiple, sky-high fees. Opening an account is a one-time fee of as much as $95. You’ll then pay fees monthly and annually as well.

Bank of Baroda has a minimum CIBIL score requirement of 750 for issuing a credit card.

The usual credit limit is 2X or 3X of your monthly income. Suppose your salary slip shows Rs. 50,000 per month. You can expect a Rs. 1 Lakh – 1.5 Lakh credit limit.

Ideally, it takes up to 21 working days from the date of application to get your credit card delivered to your address.