HDFC Moneyback Plus Credit card can be considered a superior version of the HDFC Moneyback Credit Card previously issued by the Bank. Although the two cards have the same inclusion & annual fee (Rs. 500), The MoneyBack Plus card offers a higher reward rate. With this card, you can earn a maximum of 20 cash points on every Rs. 150 that will cost you.

Speaking of the dining benefits the card offers, you can get a discount of up to 15% on dining at 2,000 excellent restaurants across the country. The HDFC Moneyback Plus Card allows customers to save in several ways, including fuel surcharge exemption, cost-based annual fee waivers, etc.

HDFC Moneyback Plus Creditcard Features:

HDFC Moneyback Card, like the original Moneyback Card, is one of the most popular cashback credit cards in the Indian market. You get cashback as cash points on all categories you spend with the card.

In addition to earning cash points, the card offers other benefits such as gift vouchers (achieving the prescribed cost milestones), dining discounts, fuel surcharge exemption, etc.

Welcome Benefits:

- You will receive 500 cash points as a welcome gift upon successfully paying the joining fee.

- You will also get 500 cash points every year on card renewal.

Milestone Benefits:

- You get Rs. Get a valuable gift voucher. 500 at the cost of Rs. Fifty thousand or more per calendar quarter.

Meal Benefits:

- By paying with your MoneyBack Plus credit card, you will get a discount of up to 15% on dining at over 2,000 premium restaurants.

Fuel Surcharge Exemption:

- A 1% fuel surcharge is waived on all fuel transactions when you pay using your HDFC Moneyback Plus Credit Card.

- The maximum surcharge waiver for this card is Rs. 250 per billing cycle.

Spend-Based Renewal Fee Waiver

The renewal fee of Rs. Five hundred had waived off if you spent Rs.50,000 or more in the previous anniversary year.

Reward Points and Cashback:

- You get two cash points on spend of Rs. 150.

- You get 5x cash points (10 CPs for Rs. 150) on EMI expenses at your selected merchant locations.

- Maximum cash points under this category are limited to 2,500 points per month.

- You get 10x cash points (20 CPs for Rs. 150) on expenses incurred on Amazon, Flipkart, Big Basket, Reliance Smart Superstore, and Swiggy.

- Bonus cash points under this category are limited to 2,500 points per month.

- These cash points are valid for two years from the date of accrual.

- No cash points on fuel transactions, wallet reloads, and voucher purchases.

Reward Points/Cashback Redemption:

- 1 Cash Point = Re. 0.25 statement for redemption against cash.

- You can redeem points against cash credit by logging into your net banking account, and you must have at least 500 cash points.

- One cash point = re. 0.25 for the redemption of flight/hotel bookings on Smartbuy.

- Up to 50% of bookings can be made through cash points, and the balance must be paid through the cardholder account.

- One cash point = re. 0.25 for redemption against the product catalogue.

- One cash point = 0.25 for redemption against airmail.

HDFC MoneyBack Plus Creditcard Limit:

HDFC Bank does not disclose the credit limit assigned to HDFC Plus credit cardholders, as there is no set limit for each, and it varies for different cardholders. Factors that affect your credit card limit include your credit score, past payment history, income, etc.

- If you are a high-income candidate or have an excellent credit score, you will get a higher credit limit than the ones you have.

- If you have a low credit limit, you should try to build a good score and apply for a higher credit limit.

- You can contact your bank customer care, fill out an online application form for card up-grading, or visit a branch.

HDFC Moneyback Plus Creditcard fees:

- HDFC Bank Moneyback Plus Creditcard Annual Fee Rs. 500. This annual fee will be waived from the second year if you have spent Rs 50,000 or more in the previous year.

- The interest rate on this card is 4.6% per month and 43.2% per annum.

- The foreign currency markup fee on the MoneyBack Plus card is 3.5% on all foreign currency transactions.

- 2.5% of the cash withdrawal fee on this credit card up to a minimum of Rs. 500.

- This fee is charged when you withdraw cash using your Moneyback Plus card.

Eligibility Criteria for HDFC Moneyback Plus Creditcard:

The following table describes the income-based and age-based eligibility criteria for HDFC Moneyback Plus Credit Card:

- Salary recipients must be between 21 and 60, with a minimum monthly income of Rs. 20,000.

- Self-employed persons should be between 21 and 65 years of age, and the minimum annual income should be Rs. 6 lakhs.

- The applicant must have an acceptable credit score.

Required Documents:

The documents required to apply for HDFC Moneyback Plus Credit Card are as follows:

- Proof of Identity – Aadhar Card, PAN Card, Voter ID, Passport, Driving License, etc.

- Proof of Address – Aadhaar Card, Utility Bills, Passport, Driving License, etc.

- Income Proof – Latest three months’ salary slips/bank statements and latest ITR.

How do you apply for an HDFC Moneyback Plus Credit Card?

- You can apply for HDFC Moneyback Credit Card online by visiting the Credit Card Application page behind the website.

- To process your application, you must submit some documents, including salary slips/ITR return acknowledgement, proof of identity, and proof of residency.

Alternatively, you can also visit one of the HDFC branches and complete the application process offline as directed by the rear officials.

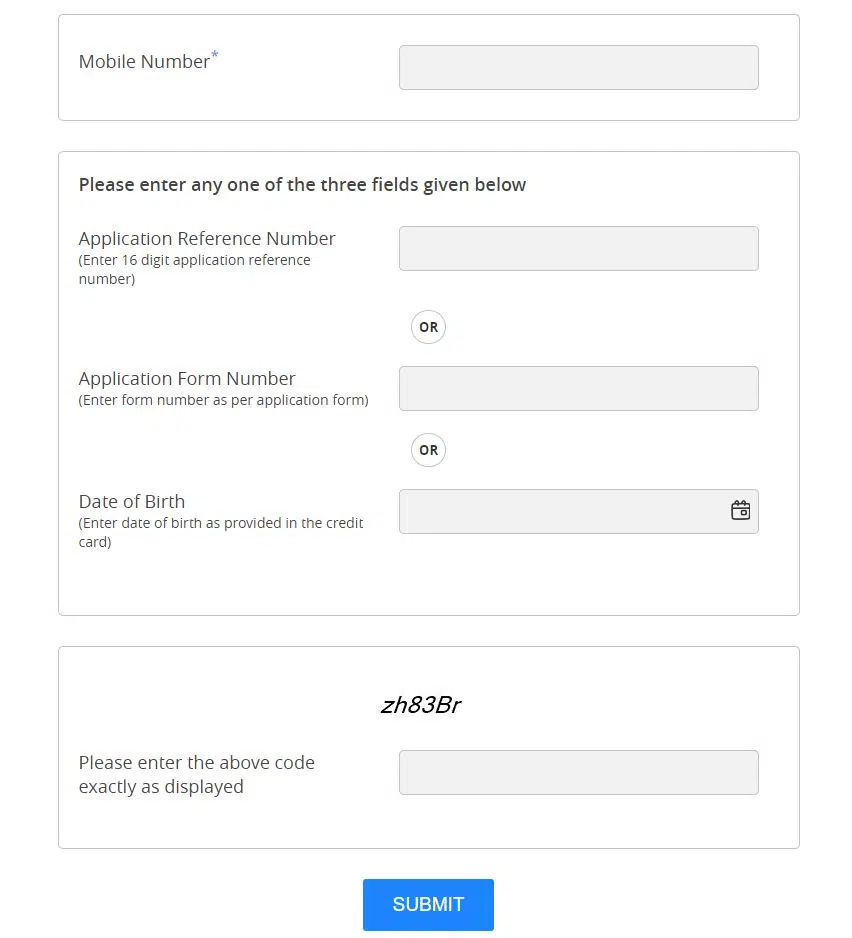

Check the status of the HDFC Moneyback Plus Credit Card:

If you have already applied for the HDFC Moneyback+ Credit Card, you can check the status of your application as follows:

- Visit the HDFC Bank Credit Card Application Tracking Page and check the status of your application by entering all the required details.

- Contact your credit card customer care and ask bank officials about your application status.

- They will ask you for some details and let you know about the progress of your application.

- You can do the same by visiting your nearest branch and asking the bank officials about your application status.

HDFC Moneyback plus Credit Card Customer Care:

- For urgent assistance regarding your HDFC Bank Moneyback Plus credit card, call the 24×7 Helpline number 1800 266 4332.

- To send your questions via email, you can visit customervices.cards@hdfcbank.com.

FAQs:

HDFC Moneyback Credit Card Limit: Rs. 25,000 – Rs. 1,50,000.

HDFC MoneyBack is one of India’s popular entry-level credit cards that offers cashback on every transaction. This option is ideal if you frequently shop online, as it provides higher rewards on online transactions.

The maximum limit of an HDFC card can go up to around Rs. 1.5 lakhs.

The Bank allows you to withdraw cash using your HDFC Bank MoneyBack+ Credit Card. However, the Bank charges a cash advance fee of 2.5% of the withdrawn amount or a minimum of Rs. 500 (whichever is higher) for withdrawing cash via your credit card.

On reporting the loss immediately, you have zero liability for any fraudulent transactions made on your Credit Card. Interest-Free Credit Period: Avail up to 50 days of interest-free period on your HDFC Bank Moneyback.