Chase Bank is one of the most significant banks in the world and has some of the best checking, savings, and business accounts available today. However, if you have too many accounts, want to switch to another bank, or are planning to move out of the country, you may need to close the Chase Bank account at some point. However, Chase offers several options for closing an account.

Introduction of closing the Chase Bank account

To begin, explain why you want to close your Chase Bank account. You might say, “I’ve been a loyal customer of Chase Bank for many years, but unfortunately, I’ve decided to close my account.”

It is also essential to thank the bank representative for their assistance. You can mention, “Thank you for your help with this. I appreciate your help.”

Gather information before close the Account.

Ensure you have an account with Chase or another bank to make the transition to a new account painless.

Before closing your Chase account, ensure any pending items have cleared. It includes checks, ATM/debit card transactions, direct deposits, or other automatic/recurring debits or credits. After you close your Account, anything unusual can bounce or reopen the Account and create unnecessary fees.

Switch all direct deposits and automatic payments to your new bank and let the Chase account you’re trying to close for a week to a few weeks to make sure nothing is using the Account automatically.

Follow the bank procedure to close Chase Bank Account

Ask a representative about the bank’s process for closing an account. Follow their instructions and provide any required documentation. It is crucial to follow the bank’s policy to ensure that the Account is closed correctly and there are no further complications.

The easiest and most preferred way to close a Chase account is to do it in person at a branch, with all the fees you’ve paid for keeping a checking or savings Account for the convenience of physically visiting a Chase bank. Location and talk to a real human being.

- To close a Chase account in person, locate a Chase bank location and visit in person.

- Chase Retail Bank locations can find on the Chase website here.

- Enter the zip code, address, city, or state and hit search.

- Chase Branch Locator can find you a Chase Bank location along with location hours.

- Most Chase banking locations are closed on Sundays but open for limited hours on Saturdays.

- Once you enter a Chase Bank location, ask for a relationship banker to help you.

- Be sure to bring information about your bank account, such as the Account you want to close, and identification, such as a driver’s license or other government ID, so that they can verify your identity.

- You may also need to provide information such as your date of birth and Social Security number, so keep that information handy.

Close the Chase Bank account by phone.

Another option is to close a bank account over the phone if you live far from a Chase retail location or prefer to avoid setting foot in a Chase banking location.

Call Chase customer service at 1-800-935-9935. Go through the phone prompts or press “0” to connect with a customer service representative. Notify a customer service representative that you want to close your Chase account.

Be prepared to provide your account numbers and personal data, such as name, date of birth, social security number, or other identifying information.

Close the Chase account online.

Another option is to close a Chase account online if you’re out of the country and need access to a Chase physical retail location or can’t call them by phone.

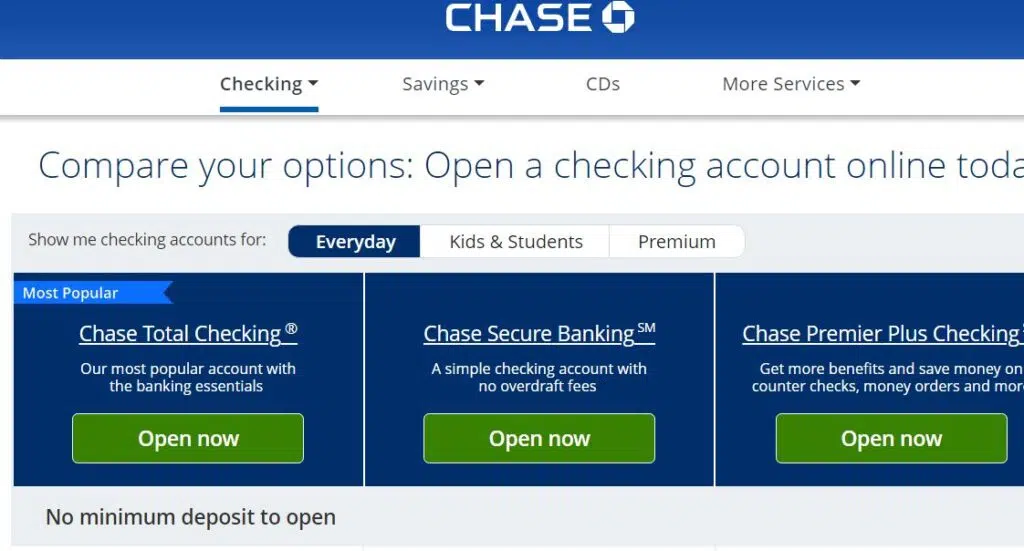

- To close a Chase account online, go to the Chase website.

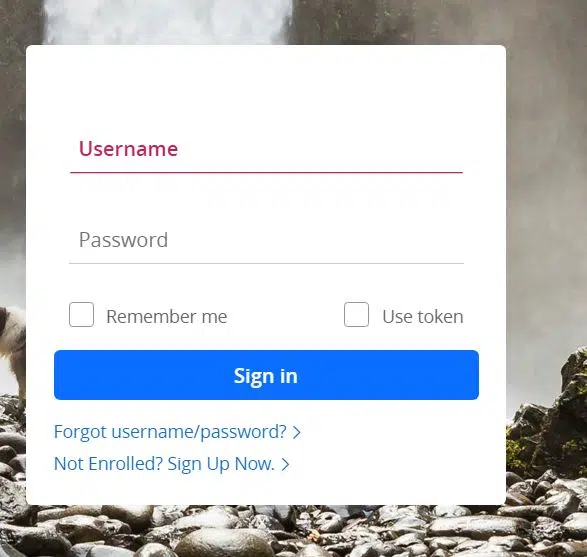

- And log into your Account.

- Next, go to the Secure Message Center to send a secure message to a Chase customer service representative.

- A Chase customer service representative will contact you again regarding your account closure request and may ask you to provide certain information.

- And they confirm your account closure request.

- After you provide this information through the secure message center, they will close your Account.

Send them a letter to close Account Via Mail.

Would you rather avoid talking to customer service? You can permanently close your Chase bank via written letter.

Send your request to:

National Bank by Mail, P.O. Box 6185, Westerville, OH 43086.

Don’t forget to include the following:

- Name / Address

- Chase Online Banking Account Number

- Message to close your Chase account

- Where to send your remaining balance (if any is left)

- Signature of all owners

As mail delivery cannot guarantee, this will take longer to close your Account.

Transfer funds

Transfer any remaining funds to another account before closing your Chase Bank account. You can transfer the funds to another Chase account or another bank account. Be sure to do this before closing the Account to save money.

Confirm closure

Ask a representative to confirm that the Account is closed. It is essential to ensure the Account is closed so you don’t have any problems in the future. You can also ask for written confirmation of the closure for your records.

A final thank you

Thank the representative for their help and patience throughout the process. Let them know you appreciate their help in closing your Account. Thank you for the services provided by Chase Bank. Even if you are closing your Account, it is essential to be polite and respectful.

Conclusion

Sometimes closing a bank account may be the right move. A Chase account may quickly be closed – and you can do so through various methods. Ensure that everything has been put in order and that you have the account information when you finally do it.

FAQs

Chase Bank charges a $35 monthly fee on Chase Private Client Checking accounts. You can avoid the fee if the following requirements had met: An average beginning day balance of at least $150,000 in this Account and any qualifying linked deposits/investments. They had linked to Chase Platinum Business Checking accounts.

Chase charges interest on remaining balances even after you close your credit card account. They must give you 45 days’ notice if they raise your interest rate.

You cannot reopen a closed Chase credit card account, but you can apply for another Chase credit card or one you previously had. Remember that Chase has rules that limit who can and cannot get their credit cards or sign-up bonus.

Each Account charges a certain monthly fee for maintenance – but the good news is that if you choose to close it yourself, it’s free.