Calculate the R&D tax credit; Research & Development (R&D) tax was introduced in 2000 to increase SMEs’ GDP on R&D from 1.7% to 3%. The R&D Expenditure Credit (RDEC) was a unique motivation for large companies in 2002.

Calculate the R&D tax credit.

Both R&D tax credit programs have been very successful, helping UK innovation to grow. In the two decades since their respective launches, various governments have continuously supported the credits, supporting forward-thinking businesses through recessions.

While R&D tax credits are a bearable relief, calculating R&D and RDEC tax – calculating how much of your spending is fit and how much you are allowed to – can be daunting for businesses that have only discovered the incentives.

In this article, you will learn whether you are fit to claim and how to get the benefits you are entitled to. From there, you’ll be better placed to decide how valuable credits can be to you and your business.

Who can claim R&D tax exemption?

If your business spends money on creating or improving products, processes, equipment, and services or developing new knowledge, you can benefit from R&D tax credits. To apply, you must:

- Must be a limited company incorporated and subject to corporation tax in the UK

- Money spent on qualifying R&D activities (your task(s) have an unsure outcome)

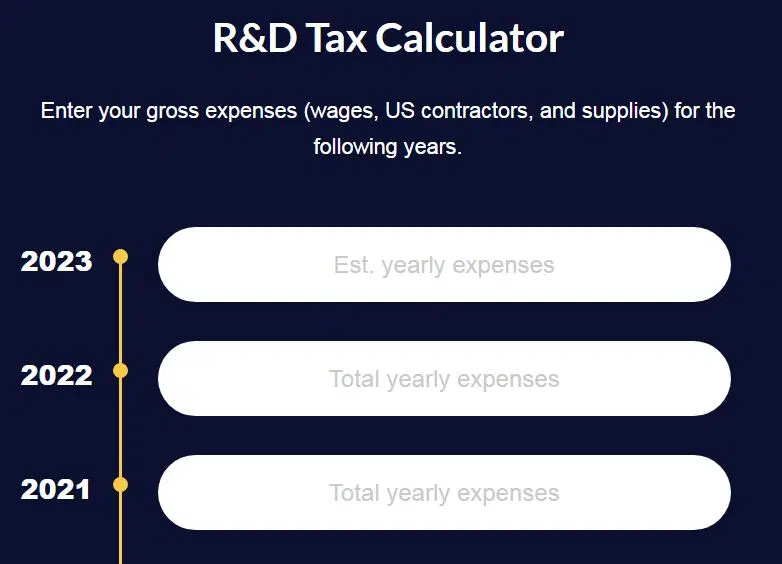

The scheme covers historical price on R&D. When accounting for R&D tax credits, you can look back to two previous accounting periods – and make R&D claims on an ongoing basis. Incentives are available to businesses of all sizes in all sectors, from construction and energy to food and insurance.

There is no minimum entry to claim; your projects can be ultimately successful or commercially fit.

Meet these standards, and you may get relief through a direct cash payment or tax deduction. SMEs can claim up to 33p for every £1 spent on qualifying projects, and larger companies can claim up to 11p through RDEC.

How to calculate R&D tax credits for SMEs?

Calculating R&D relief for an SME depends on whether your business is profitable or loss-making:

For profitable businesses, R&D tax credits can reduce your corporation tax bill. The remission rate is 25%. So if your R&D spend last year was £100,000, you could get £25,000 off your tax bill.

If you are a loss-making business, you receive your R&D tax credit in cash because you have no tax liability to offset. The remission rate is up to 33%. So if your R&D spend last year was £100,000, you could get a cash credit of £33,000.

Example:

You can now start calculating the R&D tax credit benefit. As a simple example, we use an R&D expenditure of £100,000 for this R&D tax credit accounting and apply it to the following steps.

Add the uplift to your qualifying expense:

SMEs (businesses with fewer than 500 employees and a turnover of fewer than 100 million euros or a balance sheet total of fewer than 86 million euros) can deduct 130% of their qualified expenses from their annual profit.

Get the enhanced figure by multiplying your qualifying expenditure by 130% or 1.3.

So, with our example: £100,000 x 130% = £130,000.

Estimate your taxable profit:

Subtract your improved qualifying cost figure (e.g., £130,000) from your business profit for the year to work out your revised taxable gain.

For example, if that profit is £385,000: £385,000 – £130,000 = £255,000

Calculate (and save) your new business tax liability:

Multiply your revised taxable profit by the current company tax rate (19%) to determine the new amount you must pay.

For example: £255,000 x 19% = £48,450

Subtract this figure from your pre-claimed corporation tax to determine how much you’ll save or get back.

For example: £73,150 (pre-claim corporation tax) – £48,450 (post-relief corporation tax) = £24,700

Calculating R&D tax credit for loss-making SMEs

Loss-making SMEs should also start by calculating their eligible costs, but the amounts will differ as R&D costs add to the losses.

If you are in this situation, you can:

Carry forward the excess loss, which future taxable profits can offset, or Choose 230% QE or modified loss (whichever is lower) to surrender to HMRC in exchange for a cash tax credit worth 14.5%

Let’s say our example SME loses £300,000 a year with the same £100,000 R&D QE and chooses to surrender the losses and claim relief:

£100,000 x 230% = £230,000 (increased qualifying expenditure/R&D tax losses)

£230,000 x 14.5% = £33,350 savings or refund

How to calculate the R&D tax credit for RDEC:

Research and Development Expenditure Credit (RDEC) is mainly for large companies. But in some cases, this motivation is also available to SMEs who need help to avail of the SME R&D tax credit.

Your RDEC claim has been paid as a taxable credit of 13% of the R&D payments you realize. It is taxable and gets an 11% cash benefit after tax.

These costs had offset against your tax bill, or if no tax is due, you receive the net amount in cash. So if your R&D spend last year was £100,000, you could get a cash credit or tax reduction of £11,000.

Limitations of Tax Credit Calculator:

Our calculator is a valuable tool for businesses to determine whether R&D tax incentives are helpful – hint: they are! – It is not a replacement for sound, professional advice.

A calculator only tells half the story. Your exact return depends on how you identify your qualifying expenses. At ForrestBrown, we help you uncover all your eligible costs, including those others may miss. It will help you maximize your returns and ensure your correct bottom line.

A good quality R&D tax credit adviser will only estimate your potential claim after gathering detailed information about your business. As well as a discussion with you, this may include:

- Details of your license structure and whether you are part of a group.

- Profit and loss statement and your company accounts.

- A list of all your projects and details of your fees.

- Documentation of your grant funding (if usable).

FAQs

Revenue from R&D = Research and Development Expenditure / Total Revenue.

The price-to-research ratio had calculated by dividing the company’s market value by the last 12 months’ prices on research and development.

What is the value of the R&D tax credit? The credit is worth 7-10% of qualified research expenses for most companies. It is a dollar-for-dollar credit against taxes owed. Plus, it jumps forward 20 years.

SMEs subcontracting eligible R&D activities can claim a tax removal on 65% of the payment to the subcontractor. SMEs undertaking qualifying R&D for larger companies can claim under the RDEC scheme.