The Indigo Platinum Mastercard is a good choice for people with no credit or bad credit, including students and people who have before declared bankruptcy (indebtedness).

It does not need a credit check to get preapproved; it also helps build (or rebuild) credit by making regular payments.

The Indigo Credit Card is a powerful financial tool that gives individuals access to credit, an opportunity to rebuild their credit score, and enhanced acceptance and security.

Whether you’re a first-time credit card applicant looking to improve your creditworthiness, the Indigo Credit Card can be your gateway to financial freedom.

Advantages of Indigo Platinum Mastercard

The Indigo Platinum Mastercard offers many advantages that will tempt you. Among them, the most significant are:

- No credit check to prequalify.

- 1% foreign transaction charge.

- Answering each of the three significant credit agencies.

- Soft credit pull – credit line.

- Quick and simple application process.

- High endorsement rate.

- $300 credit limit.

- 24X7 account access.

Minimum Credit Score and Other Requirements

The Indigo Platinum Mastercard has designed for people with poor credit (a FICO score of 300 to 579).

However, even with a higher credit score, you may not be approved since other factors (like income and debt) has considered.

You must meet certain minimum requirements to qualify for the Indigo Platinum card. To be prequalified or approved, you must:

- Be at least 18 years old (19 in Alabama)

- Apply from a US IP address

- Not have had an Indigo account that has charged off due to delinquency

- Provide:

- Your name

- Email address

- Physical address

- Date of birth

- Social Security number

- Monthly income and expenses

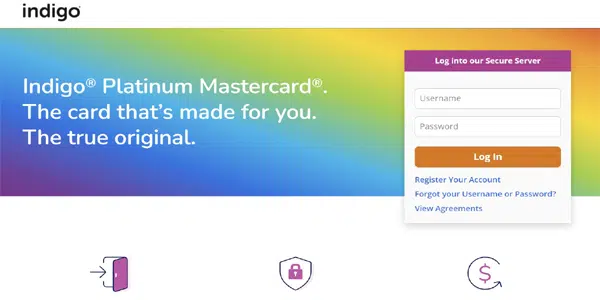

Indigo Platinum Mastercard login

You can manage your Indigo Credit Card and access various services such as checking your transaction history, making payments, and checking your account statement by logging into your account. If you input incorrect login credentials, your account will lock for 15 minutes.

- Register your Indigo Credit Card for online account access. Click “Register” and enter your account number, date of birth (DOB), and Social Security number to verify your credit card account.

- Choose your Indigo Credit Card username and Password. The username and Password cannot include spaces.

- Log in with the User name and Password. From the Genesis Financial Solutions login page website, fill out the Username and Password blanks using your new credentials, and click “Login” to access your account.

How to Apply for Indigo Platinum Credit Card?

The process to apply for the Indigo Platinum Mastercard is straightforward.

- Visit the official website of Indigo Card.

- Click on the Prequalify Now button.

- Fill in the required details, such as your Name, Address, Email, Phone Number, Date of Birth, and Social Security Number.

- Click on the Prequalify Now button again.

- Within a few minutes, your prequalification status will be available.

- If you have prequalified, you will present with the available Indigo cards.

- Select a card and click Apply Now.

Your new Indigo Mastercard should arrive within 14 business days of approval.

Indigo credit card activation

To activate your Indigo Credit Card online, follow these steps:

- Visit to activate it on a web browser.

- Click on the Register Your Account option located below the Log In button.

- Fill in your card number, date of birth, and social security number.

- You have to click on the Continue to Next Step button.

- It would help if you created a username and Password for your online card account on the next screen.

- Follow the on-screen prompts in the Activate Card section to complete the process.

Activate your Indigo Card Over the Phone

Alternatively, you can activate your Indigo Credit Card by calling customer service at (800) 353-5920. They’ll ask for information to verify your identity and then guide you through activation.

How to Activate Indigo Credit Card Using Mobile App

Download the Indigo Card app from the App Store or Google Play to activate your card through the mobile app. Sign in to your account, navigate to the Activate Card section, fill in the required information, and follow the prompts to complete the process.

Check Indigo Platinum Mastercard Application Status

Call Customer Care at (866) 946-9545 to check the application status for an Indigo Credit Card. When the automated system asks for an account number, keep pressing or holding the pound key till it tells you to press “1” to talk with a customer care expert.

In most situations, you’ll hear back within a few minutes after submitting your application online. Your card will come in 14 days if you are accepted. If you have denied it, you will receive a letter explaining why from 6 a.m. to 6 p.m. Pacific time, seven days, you can call Indigo Credit Card Customer Care at +1-866-946-9545.

Please call our Lost/Stolen Department at +1-888-260-4532 if you have not received your card within 21 days of acceptance. They are available seven days a week, 24 hours a day.

You may anticipate being authorized for a credit card and receiving it in the mail in 3-4 weeks. Expect clearance to take 7-10 business days and delivery to take 7-10 business days if you are waiting to be accepted.

What is the Indigo credit card limit?

The limit is $300. It is worth starting a credit limit for an un-made secure credit card for people with bad or poor credit. It is vital to note that cardholders may start with less available credit since the card’s annual fee of $0 – $99 will charge when the account has opened.

How to make Indigo Platinum Mastercard Payments?

There are multiple options you can use to make payments on your card. Be aware that the Indigo Platinum card needs at least a monthly payment of $25 or 1% of the card balance, whichever is greater.

Online

To access your account, log in online and click My Account. You can access your monthly bills in the Bill Pay tab, enroll to receive paperless statements and make payments via direct deposit or bank transfer.

Be sure to submit your payments by 5 p.m. PST to ensure they have been credited on the same day.

By Phone

We can make payments by phone by calling Indigo’s customer service line at 866-946-9545. A customer service agent can help you navigate the online bill payment services between 6 a.m. and 6 p.m. PST, Monday through Friday.

By Mail

We can send a check or money order for mailed payments.

Payments should mail to: Genesis FS Card Services, PO Box 4477, Beaverton, OR 97076-4477

Is Indigo a good credit card?

The Indigo credit card is the best-unsecured card for people with bad credit.

There are only many choices out there in this category. If we want to build credit without making a security deposit, consider Indigo since it reports monthly to the major credit bureaus (TransUnion, Experian, and Equifax).

You can prequalify with a soft inquiry and see if you’re eligible without hurting your credit. But keep in mind that prequalification doesn’t guarantee your approval!

But it would help if you also considered its drawbacks. The Indigo credit card’s credit limit is only $300.

Depending on your creditworthiness, you will be charged a yearly fee of $0, $59, or $75 in the first year and $99 after, further lowering your available credit. Its regular APR is 24.9% above the market average, and the cash advance APR is 29.9%.

The Indigo credit card app

You can download the Indigo app from Google playstore and apple store.

- iPhone: Requires iOS 12.0 or later.

- iPod touch: Requires iOS 12.0 or later.

- Size: 58.3 MB

Indigo Platinum Mastercard Customer Service

To contact customer service directly, call 866-946-9545. When you call, you will ask to enter your card number.

If you don’t have a card, wait in line to be transferred to a person. Customer service representatives can help you from 6 a.m. to 6 p.m. PST.

You can also call this number to request a PIN be sent to you via mail to access cash at ATMs securely. If you prefer to contact us by mail:

Genesis FS Card Services | PO Box 4477 Beaverton, OR | 97076-4477 Our toll-free customer care service: 1-800-353-5920

Conclusion

The Indigo Platinum card will mostly benefit those with poor credit (or no credit history) who want to improve their credit score. Since your payment history reports to the major credit bureaus each month, you will see results quickly from making timely payments.

However, if you can put a security deposit down or qualify for a store card, other cards give access to higher credit limits and don’t charge annual fees. If you qualify for one of these cards, they might be better choices.

FAQs

Yes, the Indigo Credit Card has designed for individuals with poor or no credit to help them build their credit score.

Contact Indigo Credit Card customer service at (800) 353-5920.

Yes, you can activate your card over the phone by calling the customer service number printed on the sticker on the front of your card.