ShopHQ Credit Card was designed for ShopHQ. The Synchrony Bank issues it. Here are some exciting benefits you will get with the ShopHQ Credit Card.

Now, if the ShopHQ Credit Card is right for you, you must read the article up to the end.

About the ShopHQ Credit Card:

The ShopHQ Credit Card is a retail credit card offered by the shopping network ShopHQ.

It provides exclusive benefits to cardholders, including discounts, access to a rewards program, flexible payment options, and VIP event invitations.

Shoppers can apply for this card to enhance their shopping experience and take advantage of special offers and promotions while purchasing through ShopHQ’s online platform.

Benefits of Using ShopHQ Credit Card:

There are multiple benefits to using a ShopHQ card. Credit Card Advantages Include

- Access to funds in case of emergency

- Enhanced Financial Health

- Balance Transfer

- Improved Credit Score

- Easy Loan Approval

- Affordable EMIs

Needed Credit Score for ShopHQ Credit Card:

The credit score you need for a ShopHQ Credit Card is 640 or better. That means people with at least fair credit can get approved for this card.

ShopHQ Credit Card Eligibility Criteria:

You must note that while your credit score is an important factor, plenty of other things will also impact your chances of being approved for the ShopHQ Card. Some other key criteria include

- Your Income

- Existing Debt Load

- Minimum 18 years of age

- Number of Open Accounts

- Recent Credit Inquiries

- Employment

- Housing status

Since you had considered all these criteria, you could get approved with a slightly low credit score. However, it is best to wait to apply until you meet the ShopHQ credit score requirement.

How to Apply for the ShopHQ Credit Card?

The application process for the ShopHQ Card is quite simple. You need to follow some basic things to complete the process.

You may face a few difficulties for the first time. In that case, you can follow the instructions below:

Log in to your ShopHQ online account.

Visit the ShopHQ Card webpage and click on “Apply Now.”

- Fill out the application form by providing your primary phone number, date of birth, address, SSN/ITIN, and annual net income.

- Click on “Continue” to complete the application process.

- Most applicants receive a decision in seconds. If you need to be immediately approved or denied, allow seven to ten business days for the issuer to review your application.

How to Manage ShopHQ Credit Card?

You must register online to manage your ShopHQ Card. You need to follow the instructions below to register for online access:

- First, you have to visit this website link.

- Then, under the Secure Login option, click the Register option.

- Then, provide your account number and the zip code on the provided fields.

- After that, you need to click on Continue.

- Then, follow the further steps to complete the registration process.

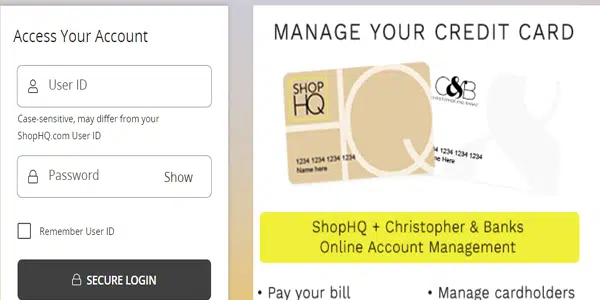

ShopHQ Credit Card Account Login Process:

You might have your user ID and password if you complete your registration option. If you have these login credentials, then you need to follow the instructions below:

First, you have to visit this Website link.

- Click on My Account. Then, choose the sign-in option.

- Then, on the given fields, provide your User ID and Password.

- Check the Remember User ID option box if you are using a device.

- After that, you need to click on the Secure Login option.

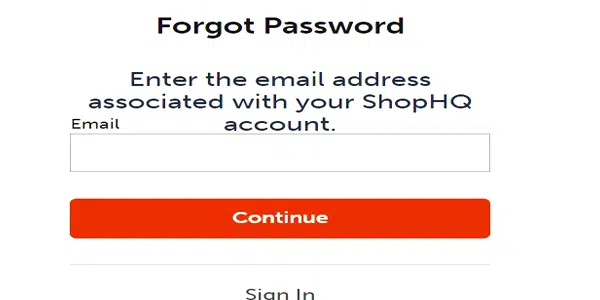

How to Reset ShopHQ Credit Card Account Password?

If you forgot your password, then you can follow these instructions:

You have to visit the Official Website.

- Click on the I Forgot My Password option.

- Provide your zip code and user ID on the given fields.

- After that, you must click the Continue button for further steps.

How to Pay ShopHQ Credit Card Bill?

You can pay your ShopHQ Card bill online. It is the easiest method to pay your bill. You can follow the instructions below to make the payment:

- First, you have to visit the website link

- Then, enter the Password and User ID in the given fields.

- After that, you need to click on the Secure Login option.

- Then, log in to your account, and you can pay easily.

Pros and Cons of ShopHQ Credit Card:

Here are the pros and cons of the credit card

Pros:

- You don’t have to pay an annual fee for the ShopHQ Card.

- On your first purchase, you can earn a $10 statement credit.

- You will get free shipping and special offer advantages throughout the year.

- Financial options are available on qualifying purchases throughout the year.

Cons:

- The purchase APR is higher than the average.

- It does not offer you rewards.

- ShopHQ does not report to any credit bureaus.

- There are few credit cards offered available with this card.

ShopHQ Customer Support :

If you have any questions about the ShopHQ Card, then you can contact the customer service:

- Customer Service: 1-800-676-5523

- Hours: 10 am-5 pm CST, seven days a week

Conclusion:

The ShopHQ Card offers many advantages to enhance your shopping experience.

It’s a valuable tool for savvy shoppers with exclusive discounts, a rewarding loyalty program, flexible payment options, and VIP event access.

Applying for this card can unlock savings and privileges, making shopping with ShopHQ even more enjoyable.

FAQs:

ShopHQ *VIP was part of the billing descriptor on your debit or credit statement when you charged the VIP membership fee. After you enroll in ShopHQ VIP and your 30-day free trial period ends, you’ll start receiving a monthly charge for your membership.

The credit score you need for a Card is 640 or better. That means people with at least fair credit can get approved for this card.

Remember a few important factors while shopping offline with your credit cards at supermarkets, retail stores, or malls to ensure safe transactions and avoid financial losses. It is important to always review your receipts after making a payment.

ShopHQ reserves the right to review card reports to qualify customers for ValuePay. If ShopHQ inquires, it will show on the customer’s credit report.