TD Student Credit Card is designed for students to suit their needs, ranging from Reward cards, no annual fee, and competitive Low Rate cards. Optional Card benefits include Card Assist, TD Auto Club, Balance Protection Insurance, and Travel Medical Insurance.

Student credit cards are great ways to start building a credit history, and it is important when you need to show lenders you can trust to borrow money for future purposes.

A TD Bank Credit Card can be very practical for everyday purchases such as laptop computers, books, and supplies. Make simple things like Internet shopping or renting a car a lot easier.

Benefits of Student Credit Card:

Build Credit Card history:

Using this card responsibly can build a positive credit history, making it easy to qualify for a loan.

Earn points or rewards:

TD Bank Credit Cards, you can earn Cash Back Dollars towards our account balance. Student TD Credit Cards let you earn points to be saved at Amazon.ca with Shop with Points or on other purchases through tdrewards.com.

Learn financial responsibilities:

Borrowing money and then paying it off each month helps you develop the lifelong skill of good payment habits.

How to manage TD Student Credit Card:

There are four ways you can manage TD Student Credit Cards.

- Credit Card payments

- Paying your balance

- Use credit limit

- Maintaining credit score

TD Student Credit Card Limit:

The credit limit of a student credit card is typically lower than that of a regular credit card. Depending on the card you get, your income, and your creditworthiness, the credit limit may be as low as $100 or $200.

What is TD’s Credit Cards for Students?

The three TD Bank Student credit cards in Canada are:

More Card Benefits and Features:

Additional Benefits & Features:

- Earn big rewards on the little things.

- TD Payment Plans

Automotive Benefits:

- Save with Avis Rent-A-Car and Budget Rent A Car

- Option to purchase TD Auto Club Membership

Security:

- Visa Zero Liability

- Chip & PIN technology

- Purchase Security and Extended Warranty Protection

- Verified by Visa

- Instant Alerts. Added convenience with TD Fraud Alerts

- Click to Pay

- We can manage credit cards in the TD Bank app.

Everyday Services:

- You can use Samsung Pay or Apple Pay wherever contactless payments are accepted.

- Emergency Cash Advances

TD Cash Back Visa Card:

It gives you to earn Cash Back Dollars with every purchase to help pay down the account balance. Earn Cash Back Dollars and Redeem them to help pay down your Account balance.

You earn 1% cash back rewards on gas, groceries, and recurring bill payments. There is a maximum annual spending limit of $5,000 for the 1% cashback category spending.

- Annual fee: $0

- Purchase interest: 19.99%

- Cash advances: 22.99%

- Additional Cardholders: $0

Eligibility Requirements: You are a Canadian resident and are of the age of majority in your province/territory of residence.

TD Emerald Flex Rate Visa Card:

A credit card you can rely on with a low-interest rate.

Eligibility Requirements: You are a Canadian resident and are of the age of majority in your province/territory of residence.

- Annual fee: $25

- Purchase interest: 4.50% to 12.75% + TD Prime

- Cash advances: 4.50% to 12.75% + TD Prime

- Additional Cardholders: $0

With a great credit score, you can save money on interest fees with the TD Emerald Flex Rate Visa Card. Its interest rates vary with the prime rate of 3.20% as of this writing.

Apart from being a low-interest credit card, the TD Emerald Flex Rate Visa has little to show in the form of rewards.

TD Rewards Visa Card:

- Annual fee: $0

- Purchase interest: 19.99%

- Cash advances: 22.99%

Eligibility Requirements: You are a Canadian resident and are of the age of majority in your province/territory of residence.

This credit card offers TD Reward Points as follows:

- 2 TD Rewards Points per $1 spent on grocery, restaurant, and fast food purchases, and recurring bill payments

- 3 TD Rewards Points per $1 spent on travel purchases via ExpediaForTD.com

- 1 TD Rewards Point per $1 spent on all other purchases

TD Student Credit Card Requirements:

- Permanent resident of Canada

- Meet the age of majority

- Provide a valid email address

You can even apply online. The application takes a few minutes, and a response has given immediately. We can apply by phone, and telephone applications can accept.

- Monday to Friday: 8 am – 10 pm ET

- Saturday to Sunday: 10 am – 6 pm ET

- Phone Number: 1-800-983-2582

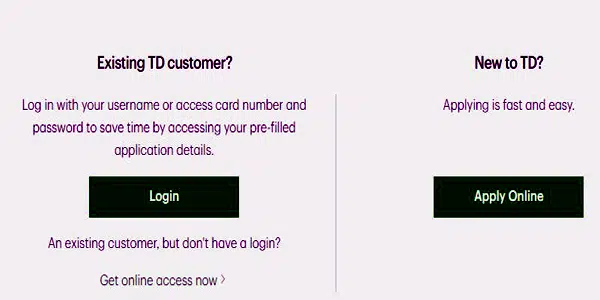

How to apply for Student TD Credit Card:

There are three types of Student Credit Cards. Select which one is the best suited for you. Apply for that credit card, which is a simple three-step process.

Select your card:

- Goto Official Website.

- Please select the student Credit Card that best suits you.

Online Apply:

- Click on Apply Online button.

- Make sure that all your information is correct and applies.

Get an instant response:

See if your application accepts by the bank or not.

FAQs:

Only spend your credit limit.

Pay the total balance of the monthly credit card bill by the due date of payment shown on the statement, not just the minimum payment.

Our student credit cards work the same way most other credit cards work. You can make purchases, either online or in person, and take cash advances using available credit. If you pay off your monthly balance, you don’t pay any interest on purchases. However, you should know that interest has charged as soon as you take a cash advance and that a fee may apply to the transaction.

TD Bank credit limits are $300 to $5,000, at a minimum, depending on the card.

Maintain a $300 minimum daily balance. Complete a monthly recurring transfer of $25 or more from an eligible and linked TD Bank Checking account for the first year. Or $5.

Keep this account with no monthly fee until age 23. After 23, you can keep this account with proof of enrollment in full-time post-secondary education.

Bank Sending limits: Per Transfer: $3,000. Twenty-four hours: $3,000.