Life insurance is attractive to many people, but not all life insurance is created equal. Term insurance is an important type of life insurance that covers a specific period. The type of term insurance plan you select depends on your situation and needs. In this article, we discuss Term Insurance vs Life Insurance in detail.

Term Insurance vs Life Insurance

Life insurance is an important part of financial planning as it helps you protect your finances throughout your lifetime and beyond. The contract guarantees a beneficiary a death benefit if a person dies while the policy is in force.

Life insurance is a contract b/w you and an insurance company that pays an assured amount when you die. Your policy usually has a term (the length you’re covered), anywhere from 10 years to your life expectancy.

Term insurance pays less money over a longer period than whole-life or universal-life policies. However, it may still be worth taking to ensure your family can maintain their lifestyle without fearing having enough money for retirement.

Understanding Term Insurance and Life Insurance

Here is an introduction about term and life insurance plans, respectively-

Term Insurance

Term insurance is a financial product that provides a specific amount for a specific period. The policyholder pays a premium for this cover but does not have to make further payments during the term.

A term insurance plan is a more affordable plan that can purchase for a fixed period. Additionally, most term insurance plans have a minimum sum assured. It means that the insurer guarantees to pay at least this amount if no claim had made or a covered event occurs during the coverage period.

Advantages of Term Insurance:

One of the primary advantages of term insurance is its low premium compared to other types of life insurance. Additionally, it is a simple and flexible option tailored to individual needs. You can select the term length and amount of coverage that works best for you.

Disadvantages of term insurance:

Term insurance also has some disadvantages. First, it has no cash value or investment component. Therefore, if the policyholder defaults, there will be no payment, and the premiums paid will lose. Second, the term is limited, which means that if the policyholder wants to renew the policy, the premiums will increase based on their age and health at the time of renewal.

Life Insurance

Life insurance is the perfect way to protect your family during an unexpected death. Additionally, life insurance plans can help build a financial cushion for you and your dependents and provide them with financial security in the event of your unexpected death.

Life insurance plans had designed to provide you and your surviving dependents lifetime coverage after you pass away. Many plans also offer death advantages if you die prematurely from an accident or illness, which helps pay for funeral expenses and other related expenses.

The most essential thing about buying a life insurance plan is knowing what coverage you are buying. Additionally, you want to provide adequate protection for all your dependents so they are left without funds or savings if someone dies unexpectedly.

Benefits of Life Insurance:

One of the major benefits of life insurance is that it provides permanent coverage throughout the policyholder’s life. Additionally, it builds cash value over time, which can be used for emergencies or as a source of retirement income. Life insurance also offers tax advantages, as the death benefit is generally tax-free, and the cash value grows tax-deferred.

Disadvantages of Life Insurance:

Life insurance also has some disadvantages:

- It carries higher premiums as compared to term insurance.

- It is a complex product that requires a deep understanding of its workings.

- It is less flexible than term insurance, as premiums, amount of coverage and other policy features had usually fixed.

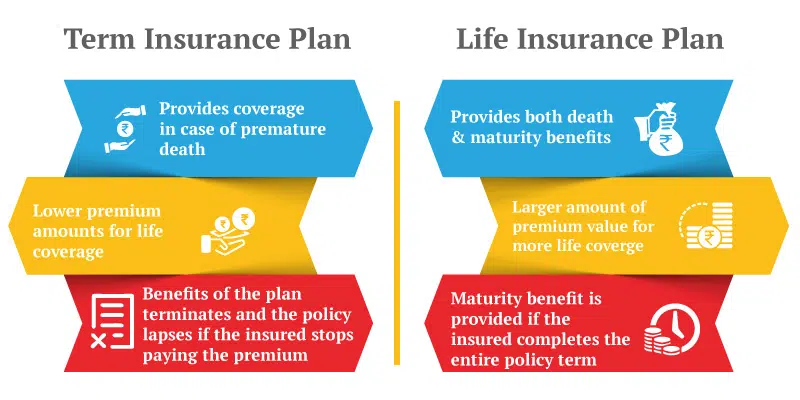

Difference between term and life insurance

The life insurance plan covers you and your family in case of your death, while term insurance covers a chosen period. Overall, a term insurance plan associates with a more affordable cost tag when compared to life insurance. If you die while the plans are in force, the financial burden on your family will be less.

Additionally, term policies can customize to suit your needs and help your family. In this blog, let’s explain the difference between Term Insurance vs Life Insurance.

Coverage:

Life insurance issues a death benefit to the candidate, while term insurance provides a cash benefit to the beneficiary. Also, a term insurance plan covers the premature death of the policyholder within the period specified in the policy document. In contrast, a life insurance policy covers premature and survival until maturity.

Premium:

Since life insurance policies cover the entire life, the premium is usually higher than term insurance.

Duration of coverage:

Life insurance coverage is for a fixed period (5-30 years), while term insurance coverage is for 10 to 35 years.

Bonus and other additions:

Life insurance companies usually add a bonus to your policy after you have paid your instalments for at least one year. Term plans usually do not provide any bonuses or additional benefits.

In case of the insured’s death, the basic sum assured pays under term insurance policies. However, there is other life insurance where bonus additions, guaranteed additions, loyalty additions and other benefits have been added.

Paid and surrendered:

Applying for the term insurance plan is called surrendering your whole life policy (the one you have now). No value paid or surrender value received.

In life insurance plans, if the premiums stop after a certain number of years, the plan gets the paid-up value. If surrendered after that, the surrender value is payable.

Flexibility:

Whole life insurance plan policies offer more flexibility than term life policies, and term insurance does not have any surrender value or cash value and also does not offer maturity benefits.

Which one to choose?

Choosing between term and life insurance depends on individual needs, age, health and financial situation. If you are young and healthy and need coverage for a specific period, term insurance may be the best option. If you want permanent coverage and a source of savings, life insurance may be the best option.

Conclusion

Term and life insurance are important financial plans that citizens of any country can take to live a peaceful life. Hence, they mainly serve to make our lives safer and secure.

The key difference b/w term and life insurance is that the coverage of the former issue for a specific period (term) while the latter provides coverage over your lifetime. So whichever insurance plan you go for, make sure it suits your needs.

FAQs

The amount provided as the death benefit in term insurance plans is much higher than the maturity benefit offered by life insurance policies.

Term insurance does not pay back death due to self-inflicted wounds.

You can get the amount back after term life insurance, but only with some term plans. There are Some term insurance plans offer only death benefits.

Yes, life insurance covers you from both natural deaths and accidental deaths.